Additionally the directors wish to know how the provision for deferred taxation would be calculated in the followingsituations under IAS12 ‘Income Taxes’:(i) On 1 November 2003, the company had granted ten million share options worth $40 million subject t

题目

Additionally the directors wish to know how the provision for deferred taxation would be calculated in the following

situations under IAS12 ‘Income Taxes’:

(i) On 1 November 2003, the company had granted ten million share options worth $40 million subject to a two

year vesting period. Local tax law allows a tax deduction at the exercise date of the intrinsic value of the options.

The intrinsic value of the ten million share options at 31 October 2004 was $16 million and at 31 October 2005

was $46 million. The increase in the share price in the year to 31 October 2005 could not be foreseen at

31 October 2004. The options were exercised at 31 October 2005. The directors are unsure how to account

for deferred taxation on this transaction for the years ended 31 October 2004 and 31 October 2005.

(ii) Panel is leasing plant under a finance lease over a five year period. The asset was recorded at the present value

of the minimum lease payments of $12 million at the inception of the lease which was 1 November 2004. The

asset is depreciated on a straight line basis over the five years and has no residual value. The annual lease

payments are $3 million payable in arrears on 31 October and the effective interest rate is 8% per annum. The

directors have not leased an asset under a finance lease before and are unsure as to its treatment for deferred

taxation. The company can claim a tax deduction for the annual rental payment as the finance lease does not

qualify for tax relief.

(iii) A wholly owned overseas subsidiary, Pins, a limited liability company, sold goods costing $7 million to Panel on

1 September 2005, and these goods had not been sold by Panel before the year end. Panel had paid $9 million

for these goods. The directors do not understand how this transaction should be dealt with in the financial

statements of the subsidiary and the group for taxation purposes. Pins pays tax locally at 30%.

(iv) Nails, a limited liability company, is a wholly owned subsidiary of Panel, and is a cash generating unit in its own

right. The value of the property, plant and equipment of Nails at 31 October 2005 was $6 million and purchased

goodwill was $1 million before any impairment loss. The company had no other assets or liabilities. An

impairment loss of $1·8 million had occurred at 31 October 2005. The tax base of the property, plant and

equipment of Nails was $4 million as at 31 October 2005. The directors wish to know how the impairment loss

will affect the deferred tax provision for the year. Impairment losses are not an allowable expense for taxation

purposes.

Assume a tax rate of 30%.

Required:

(b) Discuss, with suitable computations, how the situations (i) to (iv) above will impact on the accounting for

deferred tax under IAS12 ‘Income Taxes’ in the group financial statements of Panel. (16 marks)

(The situations in (i) to (iv) above carry equal marks)

相似考题

参考答案和解析

(b) (i) The tax deduction is based on the option’s intrinsic value which is the difference between the market price and exercise

price of the share option. It is likely that a deferred tax asset will arise which represents the difference between the tax

base of the employee’s service received to date and the carrying amount which will effectively normally be zero.

The recognition of the deferred tax asset should be dealt with on the following basis:

(a) if the estimated or actual tax deduction is less than or equal to the cumulative recognised expense then the

associated tax benefits are recognised in the income statement

(b) if the estimated or actual tax deduction exceeds the cumulative recognised compensation expense then the excess

tax benefits are recognised directly in a separate component of equity.

As regards the tax effects of the share options, in the year to 31 October 2004, the tax effect of the remuneration expensewill be in excess of the tax benefit.

The company will have to estimate the amount of the tax benefit as it is based on the share price at 31 October 2005.

The information available at 31 October 2004 indicates a tax benefit based on an intrinsic value of $16 million.

As a result, the tax benefit of $2·4 million will be recognised within the deferred tax provision. At 31 October 2005,

the options have been exercised. Tax receivable will be 30% x $46 million i.e. $13·8 million. The deferred tax asset

of $2·4 million is no longer recognised as the tax benefit has crystallised at the date when the options were exercised.

For a tax benefit to be recognised in the year to 31 October 2004, the provisions of IAS12 should be complied with as

regards the recognition of a deferred tax asset.

(ii) Plant acquired under a finance lease will be recorded as property, plant and equipment and a corresponding liability for

the obligation to pay future rentals. Rents payable are apportioned between the finance charge and a reduction of the

outstanding obligation. A temporary difference will effectively arise between the value of the plant for accounting

purposes and the equivalent of the outstanding obligation as the annual rental payments qualify for tax relief. The tax

base of the asset is the amount deductible for tax in future which is zero. The tax base of the liability is the carrying

amount less any future tax deductible amounts which will give a tax base of zero. Thus the net temporary differencewill be:

(iii) The subsidiary, Pins, has made a profit of $2 million on the transaction with Panel. These goods are held in inventory

at the year end and a consolidation adjustment of an equivalent amount will be made against profit and inventory. Pins

will have provided for the tax on this profit as part of its current tax liability. This tax will need to be eliminated at the

group level and this will be done by recognising a deferred tax asset of $2 million x 30%, i.e. $600,000. Thus any

consolidation adjustments that have the effect of deferring or accelerating tax when viewed from a group perspective will

be accounted for as part of the deferred tax provision. Group profit will be different to the sum of the profits of the

individual group companies. Tax is normally payable on the profits of the individual companies. Thus there is a need

to account for this temporary difference. IAS12 does not specifically address the issue of which tax rate should be used

calculate the deferred tax provision. IAS12 does generally say that regard should be had to the expected recovery or

settlement of the tax. This would be generally consistent with using the rate applicable to the transferee company (Panel)

rather than the transferor (Pins).

更多“Additionally the directors wish to know how the provision for deferred taxation would be calculated in the followingsituations under IAS12 ‘Income Taxes’:(i) On 1 November 2003, the company had granted ten million share options worth $40 million subject t”相关问题

-

第1题:

(b) a discussion (with suitable calculations) as to how the directors’ share options would be accounted for in the

financial statements for the year ended 31 May 2005 including the adjustment to opening balances;

(9 marks)

正确答案:(b) Accounting in the financial statements for the year ended 31 May 2005

IFRS2 requires an expense to be recognised for the share options granted to the directors with a corresponding amount shown

in equity. Where options do not vest immediately but only after a period of service, then there is a presumption that the

services will be rendered over the ‘vesting period’. The fair value of the services rendered will be measured by reference to

the fair value of the equity instruments at the date that the equity instruments were granted. Fair value should be based on

market prices. The treatment of vesting conditions depends on whether or not the conditions relate to the market price of the

instruments. Market conditions are effectively taken into account in determining the fair value of the instruments and therefore

can be ignored for the purposes of estimating the number of equity instruments that will vest. For other conditions such as

remaining in the employment of the company, the calculations are carried out based on the best estimate of the number of

instruments that will vest. The estimate is revised when subsequent information is available.

The share options granted to J. Van Heflin on 1 June 2002 were before the date set in IFRS2 for accounting for such options

(7 November 2002). Therefore, no expense calculation is required. (Note: candidates calculating the expense for the latter

share options would be given credit if they stated that the company could apply IFRS2 to other options in certaincircumstances.) The remaining options are valued as follows:

-

第2题:

(b) Misson has purchased goods from a foreign supplier for 8 million euros on 31 July 2006. At 31 October 2006,

the trade payable was still outstanding and the goods were still held by Misson. Similarly Misson has sold goods

to a foreign customer for 4 million euros on 31 July 2006 and it received payment for the goods in euros on

31 October 2006. Additionally Misson had purchased an investment property on 1 November 2005 for

28 million euros. At 31 October 2006, the investment property had a fair value of 24 million euros. The company

uses the fair value model in accounting for investment properties.

Misson would like advice on how to treat these transactions in the financial statements for the year ended 31

October 2006. (7 marks)

Required:

Discuss the accounting treatment of the above transactions in accordance with the advice required by the

directors.

(Candidates should show detailed workings as well as a discussion of the accounting treatment used.)

正确答案:

(b) Inventory, Goods sold and Investment property

The inventory and trade payable initially would be recorded at 8 million euros ÷ 1·6, i.e. $5 million. At the year end, the

amount payable is still outstanding and is retranslated at 1 dollar = 1·3 euros, i.e. $6·2 million. An exchange loss of

$(6·2 – 5) million, i.e. $1·2 million would be reported in profit or loss. The inventory would be recorded at $5 million at the

year end unless it is impaired in value.

The sale of goods would be recorded at 4 million euros ÷ 1·6, i.e. $2·5 million as a sale and as a trade receivable. Payment

is received on 31 October 2006 in euros and the actual value of euros received will be 4 million euros ÷ 1·3,

i.e. $3·1 million.

Thus a gain on exchange of $0·6 million will be reported in profit or loss.

The investment property should be recognised on 1 November 2005 at 28 million euros ÷ 1·4, i.e. $20 million. At

31 October 2006, the property should be recognised at 24 million euros ÷ 1·3, i.e. $18·5 million. The decrease in fair value

should be recognised in profit and loss as a loss on investment property. The property is a non-monetary asset and any foreign

currency element is not recognised separately. When a gain or loss on a non-monetary item is recognised in profit or loss,

any exchange component of that gain or loss is also recognised in profit or loss. If any gain or loss is recognised in equity ona non-monetary asset, any exchange gain is also recognised in equity. -

第3题:

(c) Issue of bond

The club proposes to issue a 7% bond with a face value of $50 million on 1 January 2007 at a discount of 5%

that will be secured on income from future ticket sales and corporate hospitality receipts, which are approximately

$20 million per annum. Under the agreement the club cannot use the first $6 million received from corporate

hospitality sales and reserved tickets (season tickets) as this will be used to repay the bond. The money from the

bond will be used to pay for ground improvements and to pay the wages of players.

The bond will be repayable, both capital and interest, over 15 years with the first payment of $6 million due on

31 December 2007. It has an effective interest rate of 7·7%. There will be no active market for the bond and

the company does not wish to use valuation models to value the bond. (6 marks)

Required:

Discuss how the above proposals would be dealt with in the financial statements of Seejoy for the year ending

31 December 2007, setting out their accounting treatment and appropriateness in helping the football club’s

cash flow problems.

(Candidates do not need knowledge of the football finance sector to answer this question.)

正确答案:(c) Issue of bond

This form. of financing a football club’s operations is known as ‘securitisation’. Often in these cases a special purpose vehicle

is set up to administer the income stream or assets involved. In this case, a special purpose vehicle has not been set up. The

benefit of securitisation of the future corporate hospitality sales and season ticket receipts is that there will be a capital

injection into the club and it is likely that the effective interest rate is lower because of the security provided by the income

from the receipts. The main problem with the planned raising of capital is the way in which the money is to be used. The

use of the bond for ground improvements can be commended as long term cash should be used for long term investment but

using the bond for players’ wages will cause liquidity problems for the club.

This type of securitisation is often called a ‘future flow’ securitisation. There is no existing asset transferred to a special purpose

vehicle in this type of transaction and, therefore, there is no off balance sheet effect. The bond is shown as a long term liability

and is accounted for under IAS39 ‘Financial Instruments: Recognition and Measurement’. There are no issues of

derecognition of assets as there can be in other securitisation transactions. In some jurisdictions there are legal issues in

assigning future receivables as they constitute an unidentifiable debt which does not exist at present and because of this

uncertainty often the bond holders will require additional security such as a charge on the football stadium.

The bond will be a financial liability and it will be classified in one of two ways:

(i) Financial liabilities at fair value through profit or loss include financial liabilities that the entity either has incurred for

trading purposes and, where permitted, has designated to the category at inception. Derivative liabilities are always

treated as held for trading unless they are designated and effective as hedging instruments. An example of a liability held

for trading is an issued debt instrument that the entity intends to repurchase in the near term to make a gain from shortterm

movements in interest rates. It is unlikely that the bond will be classified in this category.

(ii) The second category is financial liabilities measured at amortised cost. It is the default category for financial liabilities

that do not meet the criteria for financial liabilities at fair value through profit or loss. In most entities, most financial

liabilities will fall into this category. Examples of financial liabilities that generally would be classified in this category are

account payables, note payables, issued debt instruments, and deposits from customers. Thus the bond is likely to be

classified under this heading. When a financial liability is recognised initially in the balance sheet, the liability is

measured at fair value. Fair value is the amount for which a liability can be settled between knowledgeable, willing

parties in an arm’s length transaction. Since fair value is a market transaction price, on initial recognition fair value will

usually equal the amount of consideration received for the financial liability. Subsequent to initial recognition financial

liabilities are measured using amortised cost or fair value. In this case the company does not wish to use valuation

models nor is there an active market for the bond and, therefore, amortised cost will be used to measure the bond.

The bond will be shown initially at $50 million × 95%, i.e. $47·5 million as this is the consideration received. Subsequentlyat 31 December 2007, the bond will be shown as follows:

-

第4题:

(b) On 31 May 2007, Leigh purchased property, plant and equipment for $4 million. The supplier has agreed to

accept payment for the property, plant and equipment either in cash or in shares. The supplier can either choose

1·5 million shares of the company to be issued in six months time or to receive a cash payment in three months

time equivalent to the market value of 1·3 million shares. It is estimated that the share price will be $3·50 in

three months time and $4 in six months time.

Additionally, at 31 May 2007, one of the directors recently appointed to the board has been granted the right to

choose either 50,000 shares of Leigh or receive a cash payment equal to the current value of 40,000 shares at

the settlement date. This right has been granted because of the performance of the director during the year and

is unconditional at 31 May 2007. The settlement date is 1 July 2008 and the company estimates the fair value

of the share alternative is $2·50 per share at 31 May 2007. The share price of Leigh at 31 May 2007 is $3 per

share, and if the director chooses the share alternative, they must be kept for a period of four years. (9 marks)

Required:

Discuss with suitable computations how the above share based transactions should be accounted for in the

financial statements of Leigh for the year ended 31 May 2007.

正确答案:(b) Transactions that allow choice of settlement are accounted for as cash-settled to the extent that the entity has incurred a

liability (IFRS2 para 34). The share based transaction is treated as the issuance of a compound financial instrument. IFRS2

applies similar measurement principles to determine the value of the constituent parts of a compound instrument as that

required by IAS32 ‘Financial Instruments: Disclosure and Presentation’. The purchase of the property, plant and equipment

(PPE) and the grant to the director, both fall under this section of IFRS2 as the supplier and the director have a choice of

settlement. The fair value of the goods can be measured directly as regards the purchase of the PPE and therefore this fact

determines that the transaction is treated in a certain way. In the case of the director, the fair value of the service rendered

will be determined by the fair value of the equity instruments given and IFRS2 says that this type of share based transaction

should be dealt with in a certain way. Under IFRS2, if the fair value of the goods or services received can be measured directly

and easily then the equity element is determined by taking the fair value of the goods or services less the fair value of the

debt element of this instrument. The debt element is essentially the cash payment that will occur. If the fair value of the goods

or services is measured by reference to the fair value of the equity instruments given then the whole of the compound

instrument should be fair valued. The equity element becomes the difference between the fair value of the equity instruments

granted less the fair value of the debt component. It should take into account the fact that the counterparty must forfeit its

right to receive cash in order to receive the equity instrument.

When Leigh received the property, plant and equipment it should have recorded a liability of $4 million and an increase in

equity of $0·55 million being the difference between the value of the property, plant and equipment and the fair value of theliability. The fair value of the liability is the cash payment of $3·50 x 1·3 million shares, i.e. $4·55 million.

The accounting entry would be:

-

第5题:

(b) One of the hotels owned by Norman is a hotel complex which includes a theme park, a casino and a golf course,

as well as a hotel. The theme park, casino, and hotel were sold in the year ended 31 May 2008 to Conquest, a

public limited company, for $200 million but the sale agreement stated that Norman would continue to operate

and manage the three businesses for their remaining useful life of 15 years. The residual interest in the business

reverts back to Norman after the 15 year period. Norman would receive 75% of the net profit of the businesses

as operator fees and Conquest would receive the remaining 25%. Norman has guaranteed to Conquest that the

net minimum profit paid to Conquest would not be less than $15 million. (4 marks)

Norman has recently started issuing vouchers to customers when they stay in its hotels. The vouchers entitle the

customers to a $30 discount on a subsequent room booking within three months of their stay. Historical

experience has shown that only one in five vouchers are redeemed by the customer. At the company’s year end

of 31 May 2008, it is estimated that there are vouchers worth $20 million which are eligible for discount. The

income from room sales for the year is $300 million and Norman is unsure how to report the income from room

sales in the financial statements. (4 marks)

Norman has obtained a significant amount of grant income for the development of hotels in Europe. The grants

have been received from government bodies and relate to the size of the hotel which has been built by the grant

assistance. The intention of the grant income was to create jobs in areas where there was significant

unemployment. The grants received of $70 million will have to be repaid if the cost of building the hotels is less

than $500 million. (4 marks)

Appropriateness and quality of discussion (2 marks)

Required:

Discuss how the above income would be treated in the financial statements of Norman for the year ended

31 May 2008.

正确答案:

(b) Property is sometimes sold with a degree of continuing involvement by the seller so that the risks and rewards of ownership

have not been transferred. The nature and extent of the buyer’s involvement will determine how the transaction is accounted

for. The substance of the transaction is determined by looking at the transaction as a whole and IAS18 ‘Revenue’ requires

this by stating that where two or more transactions are linked, they should be treated as a single transaction in order to

understand the commercial effect (IAS18 paragraph 13). In the case of the sale of the hotel, theme park and casino, Norman

should not recognise a sale as the company continues to enjoy substantially all of the risks and rewards of the businesses,

and still operates and manages them. Additionally the residual interest in the business reverts back to Norman. Also Norman

has guaranteed the income level for the purchaser as the minimum payment to Conquest will be $15 million a year. The

transaction is in substance a financing arrangement and the proceeds should be treated as a loan and the payment of profits

as interest.

The principles of IAS18 and IFRIC13 ‘Customer Loyalty Programmes’ require that revenue in respect of each separate

component of a transaction is measured at its fair value. Where vouchers are issued as part of a sales transaction and are

redeemable against future purchases, revenue should be reported at the amount of the consideration received/receivable less

the voucher’s fair value. In substance, the customer is purchasing both goods or services and a voucher. The fair value of the

voucher is determined by reference to the value to the holder and not the cost to the issuer. Factors to be taken into account

when estimating the fair value, would be the discount the customer obtains, the percentage of vouchers that would be

redeemed, and the time value of money. As only one in five vouchers are redeemed, then effectively the hotel has sold goods

worth ($300 + $4) million, i.e. $304 million for a consideration of $300 million. Thus allocating the discount between the

two elements would mean that (300 ÷ 304 x $300m) i.e. $296·1 million will be allocated to the room sales and the balance

of $3·9 million to the vouchers. The deferred portion of the proceeds is only recognised when the obligations are fulfilled.

The recognition of government grants is covered by IAS20 ‘Accounting for government grants and disclosure of government

assistance’. The accruals concept is used by the standard to match the grant received with the related costs. The relationship

between the grant and the related expenditure is the key to establishing the accounting treatment. Grants should not be

recognised until there is reasonable assurance that the company can comply with the conditions relating to their receipt and

the grant will be received. Provision should be made if it appears that the grant may have to be repaid.

There may be difficulties of matching costs and revenues when the terms of the grant do not specify precisely the expense

towards which the grant contributes. In this case the grant appears to relate to both the building of hotels and the creation of

employment. However, if the grant was related to revenue expenditure, then the terms would have been related to payroll or

a fixed amount per job created. Hence it would appear that the grant is capital based and should be matched against the

depreciation of the hotels by using a deferred income approach or deducting the grant from the carrying value of the asset

(IAS20). Additionally the grant is only to be repaid if the cost of the hotel is less than $500 million which itself would seem

to indicate that the grant is capital based. If the company feels that the cost will not reach $500 million, a provision should

be made for the estimated liability if the grant has been recognised. -

第6题:

6 Assume today’s date is 16 April 2005.

Henry, aged 48, is the managing director of Happy Home Ltd, an unquoted UK company specialising in interior

design. He is wealthy in his own right and is married to Helen, who is 45 years old. They have two children – Stephen,

who is 19, and Sally who is 17.

As part of his salary, Henry was given 3,000 shares in Happy Home Ltd with an option to acquire a further 10,000

shares. The options were granted on 15 July 2003, shortly after the company started trading, and were not part of

an approved share option scheme. The free shares were given to Henry on the same day.

The exercise price of the share options was set at the then market value of £1·00 per share. The options are not

capable of being exercised after 10 years from the date of grant. The company has been successful, and the current

value of the shares is now £14·00 per share. Another shareholder has offered to buy the shares at their market value,

so Henry exercised his share options on 14 April 2005 and will sell the shares next week, on 20 April 2005.

With the company growing in size, Henry wishes to recruit high quality staff, but the company lacks the funds to pay

them in cash. Henry believes that giving new employees the chance to buy shares in the company would help recruit

staff, as they could share in the growth in value of Happy Home Ltd. Henry has heard that there is a particular share

scheme that is suitable for small, fast growing companies. He would like to obtain further information on how such

a scheme would work.

Henry has accumulated substantial assets over the years. The family house is owned jointly with Helen, and is worth

£650,000. Henry has a £250,000 mortgage on the house. In addition, Henry has liquid assets worth £340,000

and Helen has shares in quoted companies currently worth £125,000. Henry has no forms of insurance, and believes

he should make sure that his wealth and family are protected. He is keen to find out what options he should be

considering.

Required:

(a) (i) State how the gift of the 3,000 shares in Happy Home Ltd was taxed. (1 mark)

正确答案:

(a) (i) Gift of shares

Shares, which are given free or sold at less than market value, are charged to income tax on the difference between the

market value and the amount paid (if any) for the shares. Henry was given 3,000 shares with a market value of £1 at

the time of gift, so he was assessed to income tax on £3,000, in the tax year 2003/04. -

第7题:

(b) (i) State the condition that would need to be satisfied for the exercise of Paul’s share options in Memphis

plc to be exempt from income tax and the tax implications if this condition is not satisfied.

(2 marks)

正确答案:

(b) (i) Paul has options in an HMRC approved share scheme. Under such schemes, no tax liabilities arise either on the grant

or exercise of the option. The excess of the proceeds over the price paid for the shares (the exercise price) is charged to

capital gains tax on their disposal.

However, in order to secure this treatment, one of the conditions to be satisfied is that the options cannot be exercised

within three years of the date of grant. If Paul were to exercise his options now (i.e. before the third anniversary of the

grant), the exercise would instead be treated as an unapproved exercise. At that date, income tax would be charged on

the difference between the market value of the shares on exercise and the price paid to exercise the option. -

第8题:

3 You are the manager responsible for the audit of Seymour Co. The company offers information, proprietary foods and

medical innovations designed to improve the quality of life. (Proprietary foods are marketed under and protected by

registered names.) The draft consolidated financial statements for the year ended 30 September 2006 show revenue

of $74·4 million (2005 – $69·2 million), profit before taxation of $13·2 million (2005 – $15·8 million) and total

assets of $53·3 million (2005 – $40·5 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In 2001, Seymour had been awarded a 20-year patent on a new drug, Tournose, that was also approved for

food use. The drug had been developed at a cost of $4 million which is being amortised over the life of the

patent. The patent cost $11,600. In September 2006 a competitor announced the successful completion of

preliminary trials on an alternative drug with the same beneficial properties as Tournose. The alternative drug is

expected to be readily available in two years time. (7 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Seymour Co for the year ended

30 September 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

■ A change in the estimated useful life should be accounted for as a change in accounting estimate in accordance

with IAS 8 Accounting Policies, Changes in Accounting Estimates and Errors. For example, if the development

costs have little, if any, useful life after the introduction of the alternative drug (‘worst case’ scenario), the carrying

value ($3 million) should be written off over the current and remaining years, i.e. $1 million p.a. The increase in

amortisation/decrease in carrying value ($800,000) is material to PBT (6%) and total assets (1·5%).

■ Similarly a change in the expected pattern of consumption of the future economic benefits should be accounted for

as a change in accounting estimate (IAS 8). For example, it may be that the useful life is still to 2020 but that

the economic benefits may reduce significantly in two years time.

■ After adjusting the carrying amount to take account of the change in accounting estimate(s) management should

have tested it for impairment and any impairment loss recognised in profit or loss.

(ii) Audit evidence

■ $3 million carrying amount of development costs brought forward agreed to prior year working papers and financial

statements.

■ A copy of the press release announcing the competitor’s alternative drug.

■ Management’s projections of future cashflows from Tournose-related sales as evidence of the useful life of the

development costs and pattern of consumption.

■ Reperformance of management’s impairment test on the development costs: Recalculation of management’s

calculation of the carrying amount after revising estimates of useful life and/or consumption of benefits compared

with management’s calculation of value in use.

■ Sensitivity analysis on management’s key assumptions (e.g. estimates of useful life, discount rate).

■ Written management representation on the key assumptions concerning the future that have a significant risk of

causing material adjustment to the carrying amount of the development costs. (These assumptions should be

disclosed in accordance with IAS 1 Presentation of Financial Statements.) -

第9题:

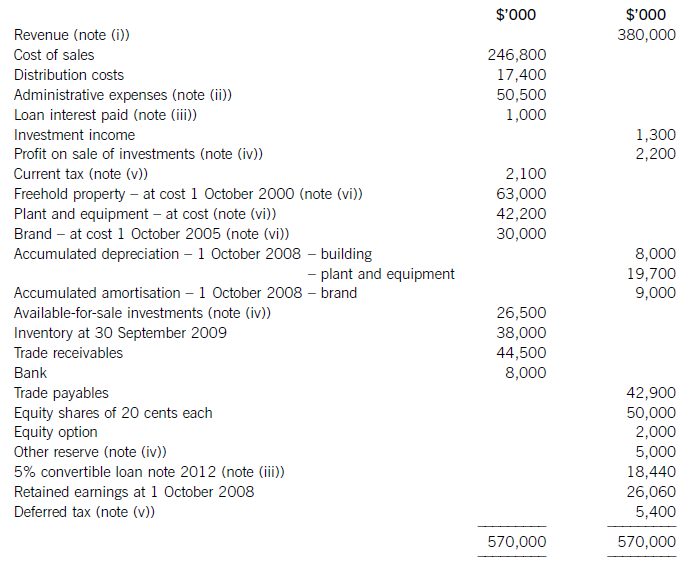

The following trial balance relates to Sandown at 30 September 2009:

The following notes are relevant:

(i) Sandown’s revenue includes $16 million for goods sold to Pending on 1 October 2008. The terms of the sale are that Sandown will incur ongoing service and support costs of $1·2 million per annum for three years after the sale. Sandown normally makes a gross profit of 40% on such servicing and support work. Ignore the time value of money.

(ii) Administrative expenses include an equity dividend of 4·8 cents per share paid during the year.

(iii) The 5% convertible loan note was issued for proceeds of $20 million on 1 October 2007. It has an effective interest rate of 8% due to the value of its conversion option.

(iv) During the year Sandown sold an available-for-sale investment for $11 million. At the date of sale it had a

carrying amount of $8·8 million and had originally cost $7 million. Sandown has recorded the disposal of the

investment. The remaining available-for-sale investments (the $26·5 million in the trial balance) have a fair value of $29 million at 30 September 2009. The other reserve in the trial balance represents the net increase in the value of the available-for-sale investments as at 1 October 2008. Ignore deferred tax on these transactions.

(v) The balance on current tax represents the under/over provision of the tax liability for the year ended 30 September 2008. The directors have estimated the provision for income tax for the year ended 30 September 2009 at $16·2 million. At 30 September 2009 the carrying amounts of Sandown’s net assets were $13 million in excess of their tax base. The income tax rate of Sandown is 30%.

(vi) Non-current assets:

The freehold property has a land element of $13 million. The building element is being depreciated on a

straight-line basis.

Plant and equipment is depreciated at 40% per annum using the reducing balance method.

Sandown’s brand in the trial balance relates to a product line that received bad publicity during the year which led to falling sales revenues. An impairment review was conducted on 1 April 2009 which concluded that, based on estimated future sales, the brand had a value in use of $12 million and a remaining life of only three years.

However, on the same date as the impairment review, Sandown received an offer to purchase the brand for

$15 million. Prior to the impairment review, it was being depreciated using the straight-line method over a

10-year life.

No depreciation/amortisation has yet been charged on any non-current asset for the year ended 30 September

2009. Depreciation, amortisation and impairment charges are all charged to cost of sales.

Required:

(a) Prepare the statement of comprehensive income for Sandown for the year ended 30 September 2009.

(13 marks)

(b) Prepare the statement of financial position of Sandown as at 30 September 2009. (12 marks)

Notes to the financial statements are not required.

A statement of changes in equity is not required.

正确答案:

(i)IAS18Revenuerequiresthatwheresalesrevenueincludesanamountforaftersalesservicingandsupportcoststhenaproportionoftherevenueshouldbedeferred.Theamountdeferredshouldcoverthecostandareasonableprofit(inthiscaseagrossprofitof40%)ontheservices.Astheservicingandsupportisforthreeyearsandthedateofthesalewas1October2008,revenuerelatingtotwoyears’servicingandsupportprovisionmustbedeferred:($1·2millionx2/0·6)=$4million.Thisisshownas$2millioninbothcurrentandnon-currentliabilities. -

第10题:

(a) The following figures have been calculated from the financial statements (including comparatives) of Barstead for

the year ended 30 September 2009:

increase in profit after taxation 80%

increase in (basic) earnings per share 5%

increase in diluted earnings per share 2%

Required:

Explain why the three measures of earnings (profit) growth for the same company over the same period can

give apparently differing impressions. (4 marks)

(b) The profit after tax for Barstead for the year ended 30 September 2009 was $15 million. At 1 October 2008 the company had in issue 36 million equity shares and a $10 million 8% convertible loan note. The loan note will mature in 2010 and will be redeemed at par or converted to equity shares on the basis of 25 shares for each $100 of loan note at the loan-note holders’ option. On 1 January 2009 Barstead made a fully subscribed rights issue of one new share for every four shares held at a price of $2·80 each. The market price of the equity shares of Barstead immediately before the issue was $3·80. The earnings per share (EPS) reported for the year ended 30 September 2008 was 35 cents.

Barstead’s income tax rate is 25%.

Required:

Calculate the (basic) EPS figure for Barstead (including comparatives) and the diluted EPS (comparatives not required) that would be disclosed for the year ended 30 September 2009. (6 marks)

正确答案:

(a)Whilstprofitaftertax(anditsgrowth)isausefulmeasure,itmaynotgiveafairrepresentationofthetrueunderlyingearningsperformance.Inthisexample,userscouldinterpretthelargeannualincreaseinprofitaftertaxof80%asbeingindicativeofanunderlyingimprovementinprofitability(ratherthanwhatitreallyis:anincreaseinabsoluteprofit).Itispossible,evenprobable,that(someof)theprofitgrowthhasbeenachievedthroughtheacquisitionofothercompanies(acquisitivegrowth).Wherecompaniesareacquiredfromtheproceedsofanewissueofshares,orwheretheyhavebeenacquiredthroughshareexchanges,thiswillresultinagreaternumberofequitysharesoftheacquiringcompanybeinginissue.ThisiswhatappearstohavehappenedinthecaseofBarsteadastheimprovementindicatedbyitsearningspershare(EPS)isonly5%perannum.ThisexplainswhytheEPS(andthetrendofEPS)isconsideredamorereliableindicatorofperformancebecausetheadditionalprofitswhichcouldbeexpectedfromthegreaterresources(proceedsfromthesharesissued)ismatchedwiththeincreaseinthenumberofshares.Simplylookingatthegrowthinacompany’sprofitaftertaxdoesnottakeintoaccountanyincreasesintheresourcesusedtoearnthem.Anyincreaseingrowthfinancedbyborrowings(debt)wouldnothavethesameimpactonprofit(asbeingfinancedbyequityshares)becausethefinancecostsofthedebtwouldacttoreduceprofit.ThecalculationofadilutedEPStakesintoaccountanypotentialequitysharesinissue.Potentialordinarysharesarisefromfinancialinstruments(e.g.convertibleloannotesandoptions)thatmayentitletheirholderstoequitysharesinthefuture.ThedilutedEPSisusefulasitalertsexistingshareholderstothefactthatfutureEPSmaybereducedasaresultofsharecapitalchanges;inasenseitisawarningsign.InthiscasethelowerincreaseinthedilutedEPSisevidencethatthe(higher)increaseinthebasicEPShas,inpart,beenachievedthroughtheincreaseduseofdilutingfinancialinstruments.Thefinancecostoftheseinstrumentsislessthantheearningstheirproceedshavegeneratedleadingtoanincreaseincurrentprofits(andbasicEPS);however,inthefuturetheywillcausemoresharestobeissued.ThiscausesadilutionwherethefinancecostperpotentialnewshareislessthanthebasicEPS. -

第11题:

I didn't attend the conference,but I wish I__there.A.had been

B.be

C.were

D.would be答案:A解析:wish后的宾语从句中,如表示过去不曾实现的愿望,则用过去完成时表示虚拟语气。 -

第12题:

单选题How much loss will the shutdown cause the government in royalties and taxes in a week?AAbout $44.8 million.

BAbout $2.8 million.

CAbout $28 million.

DAbout $4.48 million.

正确答案: C解析:

数字信息的找寻和判断。录音中指出油田的关闭导致每天损失40万桶油,以目前的油价来计算,也就意味着“the state is losing about $6.4 million a day in royalties and taxes”,即“该州每天损失大概$6. 4 million(640万美元),那么一周下来就会损失44. 8 million。因此选项A为正确答案。 -

第13题:

(c) the deferred tax implications (with suitable calculations) for the company which arise from the recognition

of a remuneration expense for the directors’ share options. (7 marks)

正确答案:

-

第14题:

3 Seejoy is a famous football club but has significant cash flow problems. The directors and shareholders wish to take

steps to improve the club’s financial position. The following proposals had been drafted in an attempt to improve the

cash flow of the club. However, the directors need advice upon their implications.

(a) Sale and leaseback of football stadium (excluding the land element)

The football stadium is currently accounted for using the cost model in IAS16, ‘Property, Plant, and Equipment’.

The carrying value of the stadium will be $12 million at 31 December 2006. The stadium will have a remaining

life of 20 years at 31 December 2006, and the club uses straight line depreciation. It is proposed to sell the

stadium to a third party institution on 1 January 2007 and lease it back under a 20 year finance lease. The sale

price and fair value are $15 million which is the present value of the minimum lease payments. The agreement

transfers the title of the stadium back to the football club at the end of the lease at nil cost. The rental is

$1·2 million per annum in advance commencing on 1 January 2007. The directors do not wish to treat this

transaction as the raising of a secured loan. The implicit interest rate on the finance in the lease is 5·6%.

(9 marks)

Required:

Discuss how the above proposals would be dealt with in the financial statements of Seejoy for the year ending

31 December 2007, setting out their accounting treatment and appropriateness in helping the football club’s

cash flow problems.

(Candidates do not need knowledge of the football finance sector to answer this question.)

正确答案:

-

第15题:

3 (a) Leigh, a public limited company, purchased the whole of the share capital of Hash, a limited company, on 1 June

2006. The whole of the share capital of Hash was formerly owned by the five directors of Hash and under the

terms of the purchase agreement, the five directors were to receive a total of three million ordinary shares of $1

of Leigh on 1 June 2006 (market value $6 million) and a further 5,000 shares per director on 31 May 2007,

if they were still employed by Leigh on that date. All of the directors were still employed by Leigh at 31 May

2007.

Leigh granted and issued fully paid shares to its own employees on 31 May 2007. Normally share options issued

to employees would vest over a three year period, but these shares were given as a bonus because of the

company’s exceptional performance over the period. The shares in Leigh had a market value of $3 million

(one million ordinary shares of $1 at $3 per share) on 31 May 2007 and an average fair value of

$2·5 million (one million ordinary shares of $1 at $2·50 per share) for the year ended 31 May 2007. It is

expected that Leigh’s share price will rise to $6 per share over the next three years. (10 marks)

Required:

Discuss with suitable computations how the above share based transactions should be accounted for in the

financial statements of Leigh for the year ended 31 May 2007.

正确答案:

(a) The shares issued to the management of Hash by Leigh (three million ordinary shares of $1) for the purchase of the company

would not be accounted for under IFRS2 ‘Share-based payment’ but would be dealt with under IFRS3 ‘Business

Combinations’.

The cost of the business combination will be the total of the fair values of the consideration given by the acquirer plus any

attributable cost. In this case the shares of Leigh will be fair valued at $6 million with $3 million being shown as share capital

and $3million as share premium. However, the shares issued as contingent consideration may be accounted for under IFRS2.

The terms of the issuance of shares will need to be examined. Where part of the consideration may be reliant on uncertain

future events, and it is probable that the additional consideration is payable and can be measured reliably, then it is included

in the cost of the business consideration at the acquisition date. However, the question to be answered in the case of the

additional 5,000 shares per director is whether the shares are compensation or part of the purchase price. There is a need

to understand why the acquisition agreement includes a provision for a contingent payment. It is possible that the price paid

initially by Leigh was quite low and, therefore, this then represents a further purchase consideration. However, in this instance

the additional payment is linked to continuing employment and, therefore, it would be argued that because of the link between

the contingent consideration and continuing employment that it represents a compensation arrangement which should be

included within the scope of IFRS2.

Thus as there is a performance condition, (the performance condition will apply as it is not a market condition) the substance

of the agreement is that the shares are compensation, then they will be fair valued at the grant date and not when the shares

vest. Therefore, the share price of $2 per share will be used to give compensation of $50,000 (5 x 5,000 x $2). (Under

IFRS3, fair value is measured at the date the consideration is provided and discounted to presented value. No guidance is

provided on what the appropriate discount rate might be. Thus the fair value used would have been $3 per share at 31 May

2007.) The compensation will be charged to the income statement and included in equity.

The shares issued to the employees of Leigh will be accounted for under IFRS2. The issuance of fully paid shares will be

presumed to relate to past service. The normal vesting period for share options is irrelevant, as is the average fair value of the

shares during the period. The shares would be expensed at a value of $3 million with a corresponding increase in equity.

Goods or services acquired in a share based payment transaction should be recognised when they are received. In the case

of goods then this will be when this occurs. However, it is somewhat more difficult sometimes to determine when services

are received. In a case of goods the vesting date is not really relevant, however, it is highly relevant for employee services. If

shares are issued that vest immediately then there is a presumption that these are a consideration for past employee services. -

第16题:

4 (a) Router, a public limited company operates in the entertainment industry. It recently agreed with a television

company to make a film which will be broadcast on the television company’s network. The fee agreed for the

film was $5 million with a further $100,000 to be paid every time the film is shown on the television company’s

channels. It is hoped that it will be shown on four occasions. The film was completed at a cost of $4 million and

delivered to the television company on 1 April 2007. The television company paid the fee of $5 million on

30 April 2007 but indicated that the film needed substantial editing before they were prepared to broadcast it,

the costs of which would be deducted from any future payments to Router. The directors of Router wish to

recognise the anticipated future income of $400,000 in the financial statements for the year ended 31 May

2007. (5 marks)

Required:

Discuss how the above items should be dealt with in the group financial statements of Router for the year ended

31 May 2007.

正确答案:

(a) Under IAS18 ‘Revenue’, revenue on a service contract is recognised when the outcome of the transaction can be measured

reliably. For revenue arising from the rendering of services, provided that all of the following criteria are met, revenue should

be recognised by reference to the stage of completion of the transaction at the balance sheet date (the percentage-ofcompletion

method) (IAS18 para 20):

(a) the amount of revenue can be measured reliably;

(b) it is probable that the economic benefits will flow to the seller;

(c) the stage of completion at the balance sheet date can be measured reliably; and

(d) the costs incurred, or to be incurred, in respect of the transaction can be measured reliably.

When the above criteria are not met, revenue arising from the rendering of services should be recognised only to the extent

of the expenses recognised that are recoverable. Because the only revenue which can be measured reliably is the fee for

making the film ($5 million), this should therefore be recognised as revenue in the year to 31 May 2007 and matched against

the cost of the film of $4 million. Only when the television company shows the film should any further amounts of $100,000

be recognised as there is an outstanding ‘performance’ condition in the form. of the editing that needs to take place before the

television company will broadcast the film. The costs of the film should not be carried forward and matched against

anticipated future income unless they can be deemed to be an intangible asset under IAS 38 ‘Intangible Assets’. Additionally,

when assessing revenue to be recognised in future years, the costs of the editing and Router’s liability for these costs should

be assessed.

-

第17题:

(c) On 1 May 2007 Sirus acquired another company, Marne plc. The directors of Marne, who were the only

shareholders, were offered an increased profit share in the enlarged business for a period of two years after the

date of acquisition as an incentive to accept the purchase offer. After this period, normal remuneration levels will

be resumed. Sirus estimated that this would cost them $5 million at 30 April 2008, and a further $6 million at

30 April 2009. These amounts will be paid in cash shortly after the respective year ends. (5 marks)

Required:

Draft a report to the directors of Sirus which discusses the principles and nature of the accounting treatment of

the above elements under International Financial Reporting Standards in the financial statements for the year

ended 30 April 2008.

正确答案:

(c) Acquisition of Marne

All business combinations within the scope of IFRS 3 ‘Business Combinations’ must be accounted for using the purchase

method. (IFRS 3.14) The pooling of interests method is prohibited. Under IFRS 3, an acquirer must be identified for all

business combinations. (IFRS 3.17) Sirus will be identified as the acquirer of Marne and must measure the cost of a business

combination at the sum of the fair values, at the date of exchange, of assets given, liabilities incurred or assumed, in exchange

for control of Marne; plus any costs directly attributable to the combination. (IFRS 3.24) If the cost is subject to adjustment

contingent on future events, the acquirer includes the amount of that adjustment in the cost of the combination at the

acquisition date if the adjustment is probable and can be measured reliably. (IFRS 3.32) However, if the contingent payment

either is not probable or cannot be measured reliably, it is not measured as part of the initial cost of the business combination.

If that adjustment subsequently becomes probable and can be measured reliably, the additional consideration is treated as

an adjustment to the cost of the combination. (IAS 3.34) The issue with the increased profit share payable to the directors

of Marne is whether the payment constitutes remuneration or consideration for the business acquired. Because the directors

of Marne fall back to normal remuneration levels after the two year period, it appears that this additional payment will

constitute part of the purchase consideration with the resultant increase in goodwill. It seems as though these payments can

be measured reliably and therefore the cost of the acquisition should be increased by the net present value of $11 million at

1 May 2007 being $5 million discounted for 1 year and $6 million for 2 years. -

第18题:

(b) (i) Advise Benny of the income tax implications of the grant and exercise of the share options in Summer

Glow plc on the assumption that the share price on 1 September 2007 and on the day he exercises the

options is £3·35 per share. Explain why the share option scheme is not free from risk by reference to

the rules of the scheme and the circumstances surrounding the company. (4 marks)

正确答案:

(b) (i) The share options

There are no income tax implications on the grant of the share options.

In the tax year in which Benny exercises the options and acquires the shares, the excess of the market value of the

shares over the price paid, i.e. £11,500 ((£3·35 – £2·20) x 10,000) will be subject to income tax.

Benny’s financial exposure is caused by the rule within the share option scheme obliging him to hold the shares for a

year before he can sell them. If the company’s expansion into Eastern Europe fails, such that its share price

subsequently falls to less than £2·20 before Benny has the chance to sell the shares, Benny’s financial position may be

summarised as follows:

– Benny will have paid £22,000 (£2·20 x 10,000) for shares which are now worth less than that.

– He will also have paid income tax of £4,600 (£11,500 x 40%). -

第19题:

3 You are the manager responsible for the audit of Keffler Co, a private limited company engaged in the manufacture of

plastic products. The draft financial statements for the year ended 31 March 2006 show revenue of $47·4 million

(2005 – $43·9 million), profit before taxation of $2 million (2005 – $2·4 million) and total assets of $33·8 million

(2005 – $25·7 million).

The following issues arising during the final audit have been noted on a schedule of points for your attention:

(a) In April 2005, Keffler bought the right to use a landfill site for a period of 15 years for $1·1 million. Keffler

expects that the amount of waste that it will need to dump will increase annually and that the site will be

completely filled after just ten years. Keffler has charged the following amounts to the income statement for the

year to 31 March 2006:

– $20,000 licence amortisation calculated on a sum-of-digits basis to increase the charge over the useful life

of the site; and

– $100,000 annual provision for restoring the land in 15 years’ time. (9 marks)

Required:

For each of the above issues:

(i) comment on the matters that you should consider; and

(ii) state the audit evidence that you should expect to find,

in undertaking your review of the audit working papers and financial statements of Keffler Co for the year ended

31 March 2006.

NOTE: The mark allocation is shown against each of the three issues.

正确答案:

3 KEFFLER CO

Tutorial note: None of the issues have any bearing on revenue. Therefore any materiality calculations assessed on revenue are

inappropriate and will not be awarded marks.

(a) Landfill site

(i) Matters

■ $1·1m cost of the right represents 3·3% of total assets and is therefore material.

■ The right should be amortised over its useful life, that is just 10 years, rather than the 15-year period for which

the right has been granted.

Tutorial note: Recalculation on the stated basis (see audit evidence) shows that a 10-year amortisation has been

correctly used.

■ The amortisation charge represents 1% of profit before tax (PBT) and is not material.

■ The amortisation method used should reflect the pattern in which the future economic benefits of the right are

expected to be consumed by Keffler. If that pattern cannot be determined reliably, the straight-line method must

be used (IAS 38 ‘Intangible Assets’).

■ Using an increasing sum-of-digits will ‘end-load’ the amortisation charge (i.e. least charge in the first year, highest

charge in the last year). However, according to IAS 38 there is rarely, if ever, persuasive evidence to support an

amortisation method that results in accumulated amortisation lower than that under the straight-line method.

Tutorial note: Over the first half of the asset’s life, depreciation will be lower than under the straight-line basis

(and higher over the second half of the asset’s life).

■ On a straight line basis the annual amortisation charge would be $0·11m, an increase of $90,000. Although this

difference is just below materiality (4·5% PBT) the cumulative effect (of undercharging amortisation) will become

material.

■ Also, when account is taken of the understatement of cost (see below), the undercharging of amortisation will be

material.

■ The sum-of-digits method might be suitable as an approximation to the unit-of-production method if Keffler has

evidence to show that use of the landfill site will increase annually.

■ However, in the absence of such evidence, the audit opinion should be qualified ‘except for’ disagreement with the

amortisation method (resulting in intangible asset overstatement/amortisation expense understatement).

■ The annual restoration provision represents 5% of PBT and 0·3% of total assets. Although this is only borderline

material (in terms of profit), there will be a cumulative impact.

■ Annual provisioning is contrary to IAS 37 ‘Provisions, Contingent Liabilities and Contingent Assets’.

■ The estimate of the future restoration cost is (presumably) $1·5m (i.e. $0·1 × 15). The present value of this

amount should have been provided in full in the current year and included in the cost of the right.

■ Thus the amortisation being charged on the cost of the right (including the restoration cost) is currently understated

(on any basis).

Tutorial note: A 15-year discount factor at 10% (say) is 0·239. $1·5m × 0·239 is approximately $0·36m. The

resulting present value (of the future cost) would be added to the cost of the right. Amortisation over 10 years

on a straight-line basis would then be increased by $36,000, increasing the difference between amortisation

charged and that which should be charged. The lower the discount rate, the greater the understatement of

amortisation expense.

Total amount expensed ($120k) is less than what should have been expensed (say $146k amortisation + $36k

unwinding of discount). However, this is not material.

■ Whether Keffler will wait until the right is about to expire before restoring the land or might restore earlier (if the

site is completely filled in 10 years).

(ii) Audit evidence

■ Written agreement for purchase of right and contractual terms therein (e.g. to make restoration in 15 years’ time).

■ Cash book/bank statement entries in April 2005 for $1·1m payment.

■ Physical inspection of the landfill site to confirm Keffler’s use of it.

■ Annual dump budget/projection over next 10 years and comparison with sum-of-digits proportions.

■ Amount actually dumped in the year (per dump records) compared with budget and as a percentage/proportion of

the total available.

■ Recalculation of current year’s amortisation based on sum-of-digits. That is, $1·1m ÷ 55 = $20,000.

Tutorial note: The sum-of-digits from 1 to 10 may be calculated long-hand or using the formula n(n+1)/2 i.e.

(10 × 11)/2 = 55.

■ The basis of the calculation of the estimated restoration costs and principal assumptions made.

■ If estimated by a quantity surveyor/other expert then a copy of the expert’s report.

■ Written management representation confirming the planned timing of the restoration in 15 years (or sooner). -

第20题:

Under her leadership, the group’s ______ grew from less than one million dollars to more than ten million.

A data

Bbudget

Citem

Dpiece

参考答案:B

-

第21题:

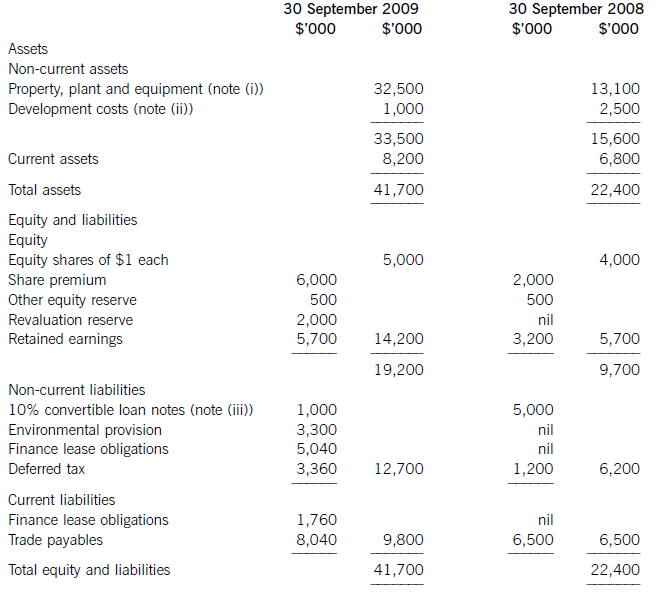

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

正确答案:

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced. -

第22题:

For the year just ended, N company had an earnings of$ 2 per share and paid a dividend of $ 1. 2 on its stock. The growth rate in net income and dividend are both expected to be a constant 7 percent per year, indefinitely. N company has a Beta of 0. 8, the risk - free interest rate is 6 percent, and the market risk premium is 8 percent.

P Company is very similar to N company in growth rate, risk and dividend. payout ratio. It had 20 million shares outstanding and an earnings of $ 36 million for the year just ended. The earnings will increase to $ 38. 5 million the next year.

Requirement :

A. Calculate the expected rate of return on N company 's equity.

B. Calculate N Company 's current price-earning ratio and prospective price - earning ratio.

C. Using N company 's current price-earning ratio, value P company 's stock price.

D. Using N company 's prospective price - earning ratio, value P company 's stock price.

答案:解析:A. The expected rate of return on N company's equity =6% +0. 8*8% =12.4%

B. Current price -earning ratio = (1. 2/2) * (1 +7% )/ (12.4% -7% ) =11. 89

Prospective price - earning ratio = (1. 2/2) / (12. 4% - 70% ) =11. 11

C. P company's stock = 11. 89* 36/20 = 21. 4

D. P company's stock = 11. 11* 38. 5/20 = 21. 39

-

第23题:

单选题Supposing 1 million leukemia cells were killed after 24 hours of exposure to radio waves, how many healthy cells would be killed under the same condition?A1.2 million.

B1.4 million.

C0.8 million.

D2 million.

正确答案: D解析:

数字的找寻和判断。录音中提到“In the Italian study, after 24 hours 20 percent mole leukemia cells died than healthy cells but longer exposure to the radio waves triggered…”,可知暴露在无线电波之下24小时,被杀死的白血病细胞比正常细胞数量多出20%。也就是说,如果有1 million(100万)个白血病细胞被杀死,同时也有0.8 million(80万)的正常细胞被杀死。因此选C。