(b) Motivators. (7 marks)

题目

(b) Motivators. (7 marks)

相似考题

更多“(b) Motivators. (7 marks)”相关问题

-

第1题:

(c) Discuss the ethical and social responsibilities of the Beth Group and whether a change in the ethical and

social attitudes of the management could improve business performance. (7 marks)

Note: requirement (c) includes 2 professional marks for development of the discussion of the ethical and social

responsibilities of the Beth Group.

正确答案:

(c) Corporate social responsibility (CSR) is concerned with business ethics and the company’s accountability to its stakeholders,

and about the way it meets its wider obligations. CSR emphasises the need for companies to adopt a coherent approach to

a range of stakeholders including investors, employees, suppliers, and customers. Beth has paid little regard to the promotion

of socially and ethically responsible policies. For example, the decision to not pay the SME creditors on the grounds that they

could not afford to sue the company is ethically unacceptable. Additionally, Beth pays little regard to local customs and

cultures in its business dealings.

The stagnation being suffered by Beth could perhaps be reversed if it adopted more environmentally friendly policies. The

corporate image is suffering because of its attitude to the environment. Environmentally friendly policies could be cost effective

if they help to increase market share and reduce the amount of litigation costs it has to suffer. The communication of these

policies would be through the environmental report, and it is critical that stakeholders feel that the company is being

transparent in its disclosures.

Evidence of corporate misbehaviour (Enron, World.com) has stimulated interest in the behaviour of companies. There has

been pressure for companies to show more awareness and concern, not only for the environment but for the rights and

interests of the people they do business with. Governments have made it clear that directors must consider the short-term

and long-term consequences of their actions, and take into account their relationships with employees and the impact of the

business on the community and the environment. The behaviour of Beth will have had an adverse effect on their corporate

image.

CSR requires the directors to address strategic issues about the aims, purposes, and operational methods of the organisation,

and some redefinition of the business model that assumes that profit motive and shareholder interests define the core purpose

of the company. The profits of Beth will suffer if employees are not valued and there is poor customer support.

Arrangements should be put in place to ensure that the business is conducted in a responsible manner. The board should

look at broad social and environmental issues affecting the company and set policy and targets, monitoring performance and

improvements.

-

第2题:

(c) Explain what ‘fiduciary responsibility’ means and construct the case for broadening the football club board’s

fiduciary responsibility in this case. (7 marks)

正确答案:

(c) Fiduciary responsibility

Definition of ‘fiduciary responsibility’

A fiduciary responsibility is a duty of trust and care towards one or more constituencies. It describes direction of accountability

in that one party has a fiduciary duty to another. In terms of the case, the question refers to whose interests the directors of

the football club should act in. Traditionally, the fiduciary duty of directors in public companies is to act in the economic

interests of shareholders who invest in the company but are unable to manage the company directly. The case raises a number

of issues concerning broadening the fiduciary duties of the directors of the football club with regard to the building of the new

stadium, to other stakeholder groups.

The case for extending fiduciary responsibility

Although the primary fiduciary duty of directors in large public companies will be to shareholders, directors in businesses such

as the football club described in the case may have good reason to broaden their views on fiduciary responsibility. This would

involve taking into account, and acting in the interests of, the local wildlife centre, the residents, the school, the local

government authority and the fans. The stakeholders in the case are not in agreement on the outcome for the new stadium

and the club will need to privilege some stakeholders over others, which is a common situation whenever a proposal involving

multiple impacts is considered. The specific arguments for broadening the fiduciary duties in this case include the following:

Such an acceptance of claims made on the football club would clearly demonstrate that the club values the community of

which it considers itself a part.

It would help to maintain and manage its local reputation, which is important in progressing the stadium project.

To broaden the fiduciary responsibility in this case would be to an important part of the risk management strategy, especially

with regard to risks that could arise from the actions of local stakeholders.

It could be argued that there is a moral case for all organisations to include other stakeholders’ claims in their strategies as it

enfranchises and captures the views of those affected by an organisation’s policies and actions. -

第3题:

(c) (i) Using ONLY the above information, assess the competitive position of Diverse Holdings Plc.

(7 marks)

正确答案:

(c) (i) Organic Foods Ltd (OFL) with a market share of 6·66% is the market leader at 30 November 2005 and is forecast to

have a market share of 8% by 30 November 2007. Operating profits appear to be healthy and therefore it seems

reasonable to regard OFL as a current ‘strength’ of Diverse Holdings Plc. This is supported by the fact that OFL has built

up a very good reputation as a supplier of quality produce.

Haul Trans Ltd was acquired on 1 December 2005 and has a demonstrable record of recent profitability. It is noticeable

that the profitability of HTL is forecast to increase by 40% (excluding inflation) during its first two years of ownership.

No one organisation appears to dominate the market. Forecast profits are expected to grow significantly from an almost

static turnover and thus more information is required regarding how this increase in profitability is to be achieved.

Management may have identified opportunities for achieving significant cost savings and/or forming business

relationships with new and more profitable customers, while ceasing to service those customers who are less profitable.

Kitchen Appliances Ltd (KAL) has been identified as both a weakness and threat. KAL’s market is slowly contracting,

but its share is falling more quickly. It was almost the market leader at 30 November 2005. Judging by its fall in the

level of operating profit KAL is carrying heavy fixed costs which must make it more difficult to compete. Indeed, it is

forecast to make a loss during the year ending 30 November 2007. KAL has suffered from squeezed margins as a

consequence of competition from low cost imports. The situation may be further exacerbated as competition from abroad

intensifies.

Paper Supplies Ltd (PSL) has stood still in a growing market, one which is dominated by a single supplier. PSL appears

to be struggling to achieve any growth in turnover, profits and therefore cash flow. PSL cannot really compete with a

narrow range of products and only two customers.

Office Products Ltd (OPL) is growing but appears unable to increase its operating profit in % terms. It appears to be

operating in a high-growth market but unable to achieve a reasonable market share in spite of the fact that its products

are highly regarded by health and safety experts. -

第4题:

(ii) Service quality; and (7 marks)

正确答案:

(ii) Quality of service is the totality of features and characteristics of the service package that bear upon its ability to satisfy

client needs. To some extent the number of complaints and the need to provide non-chargeable consultations associated

with the remedying of those complaints is indicative of a service quality problem that must be addressed. Hence this

problem needs to be investigated at the earliest opportunity. Assuming consultants could have otherwise undertaken

chargeable work, the revenue foregone as a consequence of the remedial consultations relating to commercial work

amounted to (180 x £1500) = £27,000. Client complaints received by HLP during the year amounted to 1·24% of

consultations undertaken by commercial advisors whereas none were budgeted. In contrast, competitor MAS received

135 complaints which coincided with the number of non-chargeable consultations undertaken by them. This may

indicate that MAS operate a policy of a remedial consultation in respect of all complaints received from clients.

With regard to the number of on-time consultations, HLP only achieved an on-time consultation percentage of 94·4%

which is far inferior to that of 99% achieved by competitor MAS. Also, HLP re-scheduled the appointment times of

1,620 (3%) of its total consultations whereas competitor MAS only re-scheduled 0·5% of its consultation times. The

percentage number of successful consultations provided by HLP and MAS was 85% and 95% respectively which

indicates that competitor MAS possesses a superior skills-base to that of HLP.

The most alarming statistic lies in the fact that HLP was subject to three successful legal actions for negligence. This

may not only account for the 150% increase in the cost of professional indemnity insurance premiums but may also

result in a loss of client confidence and precipitate a considerable fall in future levels of business should the claims

become much publicised. -

第5题:

(b) Compute Gloria’s total income tax and national insurance liability for 2006/07. (7 marks)

正确答案:

-

第6题:

(ii) The shares held in Date Inc and the dividend income received from that company. (7 marks)

正确答案:

(ii) Shares held in Date Inc and the related dividend income

Degrouping charge

There will be a degrouping charge in Nikau Ltd in the year ending 31 March 2008 in respect of the shares in Date Inc.

This is because Nikau Ltd has left the Facet Group within six years of the no gain, no loss transfer of the shares whilst

still owning them.

Nikau Ltd is treated as if it has sold the shares in Date Inc for their market value as at the time of the no gain, no loss

transfer. This will give rise to a gain, ignoring indexation allowance, of £201,000 (£338,000 – £137,000).

This gain will give rise to additional corporation tax of £60,300 (£201,000 x 30%).

Controlled foreign company

Date Inc is a controlled foreign company. The profits of such a company are normally attributed to its UK resident

shareholders such that they are subject to UK corporation tax.

However, none of the profits of Date Inc will be attributed to Nikau Ltd because Date Inc distributes more than 90%

(£115,000/£120,000 = 95·8%) of its chargeable profits to its shareholders.

Dividend income

Nikau Ltd is a UK resident company and is therefore subject to corporation tax on its worldwide income.

The dividend income will be grossed up in respect of the withholding tax giving rise to taxable income of £39,792

(£38,200 x 100/96). There is no underlying tax as there are no taxes on income or capital profits in Palladia.

The corporation tax of £11,938 (£39,792 x 30%) will be reduced by unilateral double tax relief equal to the withholding

tax suffered of £1,592 (£39,792 x 4%) resulting in corporation tax due of £10,346 (£11,938 – £1,592). -

第7题:

(b) Illustrate how you might use analytical procedures to provide audit evidence and reduce the level of detailed

substantive procedures. (7 marks)

正确答案:

(b) Illustration of use of analytical procedures as audit evidence

Tutorial note: Note that ‘as audit evidence’ requires consideration of substantive analytical procedures rather that the

identification of risks (relevant to part (a)).

Revenue

Analytical procedures may be used in testing revenue for completeness of recording (‘understatement’). The average selling

price of a vehicle in 2005 was $68,830 ($526·0 million ÷ 7,642 vehicles). Applying this to the number of vehicles sold

in 2006, might be projected to generate $698·8 million ($68,830 × 10,153) revenue from the sale of vehicles. The draft

financial statements therefore show a potential shortfall of $110·8 million ($(698·8 – 588·0) million) that is, 15·6%.

This should be investigated and substantiated through more detailed analytical procedures. For example, the number of

vehicles sold should be analysed into models and multiplied by the list price of each for a more accurate estimate of potential

revenue. The impact of discounts and other incentives (e.g. 0% finance) on the list prices should then be allowed for. If

recorded revenue for 2006 (as per draft income statement adjusted for cutoff and consignment inventories) is materially lower

than that calculated, detailed substantive procedures may be required in order to show that there is no material error.

‘Proof in total’/reasonableness tests

The material correctness, or otherwise, of income statement items (in particular) may be assessed through appropriate ‘proof

in total’ calculations (or ‘reasonableness’ tests). For example:

■ Employee benefits costs: the average number of employees by category (waged/salaried/apprenticed) × the average pay

rate for each might prove that in total $91·0 million (as adjusted to actual at 31 December 2006) is not materially

misstated. The average number of employees needs to be checked substantively (e.g. recalculated based on the number

of employees on each payroll) and the average pay rates (e.g. to rates agreed with employee representatives).

Tutorial note: An alternative reasonableness might be to take last year’s actual adjusted for 2006 numbers of

employees grossed-up for any pay increases during the year (pro-rated as necessary).

■ Depreciation: the cost (or net book value) of each category of asset × by the relevant straight-line (or reducing balance)

depreciation rate. If a ‘ballpark’ calculation for the year is materially different to the annual charge a more detailed

calculation can be made using monthly depreciation calculations. The cost (or net book value) on which depreciation

is calculated should be substantively tested, for example by agreeing brought forward balances to prior year working

papers and additions to purchase invoices (costings in respect of assets under construction).

Tutorial note: Alternatively, last year’s depreciation charge may be reconciled to this year’s by considering depreciation

rates applied to brought forward balances with adjustments for additions/disposals.

■ Interest income: an average interest rate for the year can be applied to the monthly balance invested (e.g. in deposit

accounts) and compared with the amount recognised for the year to 31 December 2006 (as adjusted for any accrued

interest per the bank letter for audit purposes). The monthly balances (or averages) on which the calculation is

performed should be substantiated to bank deposit statements.

■ Interest expense: if the cash balances do not go into overdraft then this may be similar expenses (e.g. prompt payment

discounts to customers). If this is to particular dealers then a proof in total might be to apply the discount rate to the

amounts invoiced to the dealer during the period.

Immaterial items

For immaterial items analytical procedures alone may provide sufficient audit evidence that amounts in the financial

statements are not materially misstated so that detailed substantive procedures are not required. For example, a comparison

of administration and distribution, maintenance and insurance costs for 2006 compared with 2005 may be sufficient to show

that material error is highly unlikely. If necessary, further reasonableness tests could be performed. For example, considering

insurance costs to value of assets insured or maintenance costs to costs of assets maintained.

Ratio analysis

Ratio analysis can provide substantive evidence that income statement and balance sheet items are not materially misstated

by considering their inter-relationships. For example:

■ Asset turnover: Based on the draft financial statements property, plant and equipment has turned over 5·2 times

($645·5/124·5) compared with 5·9 times in 2005. This again highlights that income may be overstated, or assets

overstated (e.g. if depreciation is understated).

■ Inventory turnover: Using cost of materials adjusted for changes in inventories this has remained stable at 10·9 times.

Tutorial note: This is to be expected as in (a) the cost in the income statement has increased by 9% and the value of

inventories by 8·5%.

Inventories represent the smallest asset value on the balance sheet at 31 December 2006 (7·8% of total assets).

Therefore substantive procedures may be limited to agreeing physical count of material items (vehicles) and agreeing

cutoff.

■ Average collection period: This has increased to 41 days (73·1/645·5 × 365) from 30 days. Further substantive analysis

is required, for example, separating out non-current amounts (for sales on 0% finance terms). Substantive procedures

may be limited to confirmation of amounts due from dealers (and/or receipt of after-date cash) and agreeing cutoff of

goods on consignment.

■ Payment periods: This has remained constant at 37 days (2005 – 38 days). Detailed substantive procedures may be

restricted to reconciling only major suppliers’ statements and agreeing the cutoff on parts purchased from them. -

第8题:

In relation to company law, explain:

(a) the limitations on the use of company names; (4 marks)

(b) the tort of ‘passing off’; (4 marks)

(c) the role of the company names adjudicators under the Companies Act 2006. (2 marks)

正确答案:(a) Except in relation to specifically exempted companies, such as those involved in charitable work, companies are required to indicate that they are operating on the basis of limited liability. Thus private companies are required to end their names, either with the word ‘limited’ or the abbreviation ‘ltd’, and public companies must end their names with the words ‘public limited company’ or the abbreviation ‘plc’. Welsh companies may use the Welsh language equivalents (Companies Act (CA)2006 ss.58, 59 & 60).

Companies Registry maintains a register of business names, and will refuse to register any company with a name that is the same as one already on that index (CA 2006 s.66).

Certain categories of names are, subject to the decision of the Secretary of State, unacceptable per se, as follows:

(i) names which in the opinion of the Secretary of State constitute a criminal offence or are offensive (CA 2006 s.53)

(ii) names which are likely to give the impression that the company is connected with either government or local government authorities (s.54).

(iii) names which include a word or expression specified under the Company and Business Names Regulations 1981 (s.26(2)(b)). This category requires the express approval of the Secretary of State for the use of any of the names or expressions contained on the list, and relates to areas which raise a matter of public concern in relation to their use.

Under s.67 of the Companies Act 2006 the Secretary of State has power to require a company to alter its name under the following circumstances:

(i) where it is the same as a name already on the Registrar’s index of company names.

(ii) where it is ‘too like’ a name that is on that index.

The name of a company can always be changed by a special resolution of the company so long as it continues to comply with the above requirements (s.77).(b) The tort of passing off was developed to prevent one person from using any name which is likely to divert business their way by suggesting that the business is actually that of some other person or is connected in any way with that other business. It thus enables people to protect the goodwill they have built up in relation to their business activity. In Ewing v Buttercup

Margarine Co Ltd (1917) the plaintiff successfully prevented the defendants from using a name that suggested a link with

his existing dairy company. It cannot be used, however, if there is no likelihood of the public being confused, where for example the companies are conducting different businesses (Dunlop Pneumatic Tyre Co Ltd v Dunlop Motor Co Ltd (1907)

and Stringfellow v McCain Foods GB Ltd (1984). Nor can it be used where the name consists of a word in general use (Aerators Ltd v Tollitt (1902)).

Part 41 of the Companies Act (CA) 2006, which repeals and replaces the Business Names Act 1985, still does not prevent one business from using the same, or a very similar, name as another business so the tort of passing off will still have an application in the wider business sector. However the Act introduced a new procedure to deal specifically with company names. As previously under the CA 1985, a company cannot register with a name that was the same as any already registered (s.665 Companies Act (CA) 2006) and under CA s.67 the Secretary of State may direct a company to change its name if it has been registered in a name that is the same as, or too like a name appearing on the registrar’s index of company names. In addition, however, a completely new system of complaint has been introduced.(c) Under ss.69–74 of CA 2006 a new procedure has been introduced to cover situations where a company has been registered with a name

(i) that it is the same as a name associated with the applicant in which he has goodwill, or

(ii) that it is sufficiently similar to such a name that its use in the United Kingdom would be likely to mislead by suggesting a connection between the company and the applicant (s.69).

Section 69 can be used not just by other companies but by any person to object to a company names adjudicator if a company’s name is similar to a name in which the applicant has goodwill. There is list of circumstances raising a presumption that a name was adopted legitimately, however even then, if the objector can show that the name was registered either, to obtain money from them, or to prevent them from using the name, then they will be entitled to an order to require the company to change its name.

Under s.70 the Secretary of State is given the power to appoint company names adjudicators and their staff and to finance their activities, with one person being appointed Chief Adjudicator.

Section 71 provides the Secretary of State with power to make rules for the proceedings before a company names adjudicator.

Section 72 provides that the decision of an adjudicator and the reasons for it, are to be published within 90 days of the decision.

Section 73 provides that if an objection is upheld, then the adjudicator is to direct the company with the offending name to change its name to one that does not similarly offend. A deadline must be set for the change. If the offending name is not changed, then the adjudicator will decide a new name for the company.

Under s.74 either party may appeal to a court against the decision of the company names adjudicator. The court can either uphold or reverse the adjudicator’s decision, and may make any order that the adjudicator might have made. -

第9题:

(b) State the enquiries you would make of the directors of Mulligan Co to ascertain the adequacy of the

$3 million finance requested for the new production facility. (7 marks)

正确答案:

(b) It is important to appreciate that the finance request should cover not only the cost of the construction of the new facility, but

also costs in order to get the business unit up and running, and enough cash to meet initial working capital requirements.

Mulligan Co may have sufficient cash to cover such additional expenses, but the bank will want comfort that this is the case.

Enquiries would include the following:

Who has prepared the forecast? It is important to evaluate the experience and competence of the preparer. If management

has previously prepared forecasts and capital expenditure budgets that were reliable and accurate, this adds a measure of

confidence in the preparation of the new forecast and the underlying assumptions used.

To what extent is internal finance available to cover any shortfall in the finance requirement? If there is surplus cash within

the organisation then the bank need not provide the full amount of finance necessary to start up the new business operation.

Has the cost of finance been included in the forecast? It appears that this cost is missing. Finance costs should be calculated

based on the anticipated interest rate to be applied to the loan advanced, and included in the total finance requirement.

What is the forecast operating cycle of the new business unit? In particular how long is the work in progress period, and how

much credit will be extended to customers? i.e. when will cash inflows specific to the new business unit be received? More

finance might be required to fund initial working capital shortfalls during the period when work in progress is occurring, and

before cash receipts from customers are received.

Will further raw materials be required? A request has been made for $250,000 for raw materials of timber. Other materials

may need to be purchased, for example, non-timber raw materials, and inventory of other consumables such as nuts and

bolts.

How long will the ‘initial’ inventory of raw material last? What is the planned work in progress time for the new product? More

finance may be needed to avoid a stock out of raw materials.

Construction of the new factory – is there any documentation to support the capital expenditure? For example, architect’s

plans, surveyor’s reports. This will support the accuracy of the finance requested and is an important source of evidence given

the materiality of the premises to the total amount of finance requested.

How likely is it that costs may be subject to inflation before actually being incurred? This could increase the amount of finance

required by several percentage points.

Have quotes been obtained for the new machinery to be purchased?

Purchase of new machinery – will any specific installation costs be incurred? These costs can be significant for large pieces

of capital equipment. Also, enquiries should be made regarding any delivery costs.

The budget does not appear to contain any finance request for overheads such as use of electricity during the construction

period, and hire of installation equipment. Have these overheads been included in the construction cost estimate?

Will staff need to be trained in using the new machinery? If so, any incremental costs should be included in the finance

request.

Advertising and marketing of new product – enquire of Patrick Tiler the methods that will be used to market the new product.

Some types of advertising are more of a cash drain due to their high expense e.g. television advertising is expensive and ‘up

front’ compared to magazine advertising, which is cheap and spread out. As Patrick Tiler is new to Mulligan Co, his forecast

is not based on past experience of this particular business.

LCT Bank will also consider the recoverability of the amount advanced by looking at the cash generating potential of the new

business unit. Enquiries should therefore be made regarding the likely success of the new products, for example:

– Has any market research been carried out to support the commercial viability of the new products?

– Have any contracts with retailers to carry the new products been negotiated?

– How quickly have past products generated a cash inflow?

– Is there a contingency plan in place in case the new products fail to be successful? -

第10题:

(b) A recruitment service offered to clients. (7 marks)

正确答案:

(b) Recruitment service

IFAC’s Code of Ethics for Professional Accountants does not prohibit firms from offering a recruitment service to client

companies. However several ethical problems could arise if the service were offered. The severity of these problems would

depend on the exact nature of the service provided, and the role of the person recruited into the client’s organisation.

Specific ethical threats could include:

Self-interest – clearly the motive for Becker & Co to offer this service is to generate income from audit clients, thereby creating

a financial self-interest threat. The amount received for the recruitment service depends on the magnitude of the salary of the

person employed. The more senior the person recruited, the higher their salary is likely to be, and therefore the higher the

fee to be paid to Becker & Co.

In addition, the firm could be tempted to advise positively on the recruitment of an individual merely to receive the relevant

recruitment fee, without properly considering the suitability of the person for the role.

Familiarity – when performing the audit, the auditors may be less likely to criticise or challenge the work performed by a

person they helped to recruit, as any significant problems discovered may make the recruitment appear ill-advised.

Management involvement – there is also a threat that the audit firm could be perceived to be making management decisions

by selecting employees. The firm could offer services such as reviewing the professional qualifications of a number of

applicants, and providing advice on the applicant’s suitability for the post. In addition the firm could draw up a shortlist of

candidates for interview, using criteria specified by the client. However in all cases, the final decision as to whom to hire must

be made by the client, as the audit firm should not make, or be perceived to be making, management decisions.

The threats discussed above would increase in significance if the recruitee took on a role in key management pertaining to

the finance function, such as finance director or financial controller. The threats would be less severe if the audit firm advised

on the recruitment of a junior member of the client’s finance function.

If these threats could not be reduced to a level less than clearly insignificant, then the recruitment service should not be

offered.

Commercial evaluation

The firm should consider whether there is likely to be much demand for the potential service before developing such a

resource. Some form. of market research is essential.

Offering this type of service represents a significant departure from normal audit services. The firm should consider whether

there is sufficient knowledge and expertise to offer a recruitment service. Ingrid Sharapova seems to have some experience,

but her skills may be out of date, and may not be specifically relevant to the recruitment of finance professionals. It may be

that considerable training and possibly the attainment of a new professional qualification relevant to recruitment may be

necessary for a credible service to be offered to clients.

If the recruitment service proved successful, then Ingrid could be faced with too much work as she is the only person with

relevant experience, and has no one to delegate to. If the firm decides to offer this service, then one other person should

receive appropriate training, to cover for Ingrid’s holidays and any sick leave, and to provide someone for Ingrid to delegate

to. The financial cost of such training should be considered.

Finally, Becker & Co should consider the potential damage to the firm’s reputation if the service offered is not of a high quality.

If the partners decide to pursue this business opportunity, they may wish to consider setting it up as a separate entity, so that

if the business fails or its reputation is questioned, the damage to Becker & Co would be minimised. -

第11题:

What was the price of US dollar against mark on Monday?

A.1.53 marks.

B.1.57 marks.

C.1.55 marks.

D.122.75 yen.

正确答案:B

解析:文章第二段最后一句提到On Monday trading, technical factor...as low as 1.57 marks。在星期一的交易中,由于技术的原因导致美元进一步下跌,只得以低于1.57marks的价格上市。 -

第12题:

单选题The International Association of Lighthouse authorities (IALA) buoyage system “A” uses some types of marks to distinguish safe navigation? Which type(s) does(do) not belong to the system?()Alateral marks and cardinal marks

Bsafe water marks

Cisolated danger marks and special marks

Ddangerous water marks

正确答案: B解析: 暂无解析 -

第13题:

(c) Discuss how the manipulation of financial statements by company accountants is inconsistent with their

responsibilities as members of the accounting profession setting out the distinguishing features of a

profession and the privileges that society gives to a profession. (Your answer should include reference to the

above scenario.) (7 marks)

Note: requirement (c) includes 2 marks for the quality of the discussion.

正确答案:

(c) Accounting and ethical implications of sale of inventory

Manipulation of financial statements often does not involve breaking laws but the purpose of financial statements is to present

a fair representation of the company’s position, and if the financial statements are misrepresented on purpose then this could

be deemed unethical. The financial statements in this case are being manipulated to show a certain outcome so that Hall

may be shown to be in a better financial position if the company is sold. The retained earnings of Hall will be increased by

$4 million, and the cash received would improve liquidity. Additionally this type of transaction was going to be carried out

again in the interim accounts if Hall was not sold. Accountants have the responsibility to issue financial statements that do

not mislead the public as the public assumes that such professionals are acting in an ethical capacity, thus giving the financial

statements credibility.

A profession is distinguished by having a:

(i) specialised body of knowledge

(ii) commitment to the social good

(iii) ability to regulate itself

(iv) high social status

Accountants should seek to promote or preserve the public interest. If the idea of a profession is to have any significance,

then it must make a bargain with society in which they promise conscientiously to serve the public interest. In return, society

allocates certain privileges. These might include one or more of the following:

– the right to engage in self-regulation

– the exclusive right to perform. particular functions

– special status

There is more to being an accountant than is captured by the definition of the professional. It can be argued that accountants

should have the presentation of truth, in a fair and accurate manner, as a goal. -

第14题:

(ii) Evaluate the relative advantages and disadvantages of Chen’s risk management committee being

non-executive rather than executive in nature. (7 marks)

正确答案:

(ii) Advantages and disadvantages of being non-executive rather than executive

The UK Combined Code, for example, allows for risk committees to be made up of either executive or non-executive

members.

Advantages of non-executive membership

Separation and detachment from the content being discussed is more likely to bring independent scrutiny.

Sensitive issues relating to one or more areas of executive oversight can be aired without vested interests being present.

Non-executive directors often bring specific expertise that will be more relevant to a risk problem than more

operationally-minded executive directors will have.

Chen’s four members, being from different backgrounds, are likely to bring a range of perspectives and suggested

strategies which may enrich the options open to the committee when considering specific risks.

Disadvantages of non-executive membership (advantages of executive membership)

Direct input and relevant information would be available from executives working directly with the products, systems

and procedures being discussed if they were on the committee. Non-executives are less likely to have specialist

knowledge of products, systems and procedures being discussed and will therefore be less likely to be able to comment

intelligently during meetings.

The membership, of four people, none of whom ‘had direct experience of Chen’s industry or products’ could produce

decisions taken without relevant information that an executive member could provide.

Non-executive directors will need to report their findings to the executive board. This reporting stage slows down the

process, thus requiring more time before actions can be implemented, and introducing the possibility of some

misunderstanding. -

第15题:

(ii) the factors that should be considered in the design of a reward scheme for BGL; (7 marks)

正确答案:

(ii) The factors that should be considered in the design of a reward scheme for BGL.

– Whether performance targets should be set with regard to results or effort. It is more difficult to set targets for

administrative and support staff since in many instances the results of their efforts are not easily quantifiable. For

example, sales administrators will improve levels of customer satisfaction but quantifying this is extremely difficult.

– Whether rewards should be monetary or non-monetary. Money means different things to different people. In many

instances people will prefer increased job security which results from improved organisational performance and

adopt a longer term-perspective. Thus the attractiveness of employee share option schemes will appeal to such

individuals. Well designed schemes will correlate the prosperity of the organisation with that of the individuals it

employs.

– Whether the reward promise should be implicit or explicit. Explicit reward promises are easy to understand but in

many respects management will have their hands tied. Implicit reward promises such as the ‘promise’ of promotion

for good performance is also problematic since not all organisations are large enough to offer a structured career

progression. Thus in situations where not everyone can be promoted there needs to be a range of alternative reward

systems in place to acknowledge good performance and encourage commitment from the workforce.

– The size and time span of the reward. This can be difficult to determine especially in businesses such as BGL

which are subject to seasonal variations. i.e. summerhouses will invariably be purchased prior to the summer

season! Hence activity levels may vary and there remains the potential problem of assessing performance when

an organisation operates with surplus capacity.

– Whether the reward should be individual or group based. This is potentially problematic for BGL since the assembly

operatives comprise some individuals who are responsible for their own output and others who work in groups.

Similarly with regard to the sales force then the setting of individual performance targets is problematic since sales

territories will vary in terms of geographical spread and customer concentration.

– Whether the reward scheme should involve equity participation? Such schemes invariably appeal to directors and

senior managers but should arguably be open to all individuals if ‘perceptions of inequity’ are to be avoided.

– Tax considerations need to be taken into account when designing a reward scheme. -

第16题:

(iii) Whether or not you agree with the statement of the marketing director in note (9) above. (5 marks)

Professional marks for appropriateness of format, style. and structure of the report. (4 marks)

正确答案:(iii) The marketing director is certainly correct in recognising that success is dependent on levels of service quality provided

by HFG to its clients. However, whilst the number of complaints is an important performance measure, it needs to be

used with caution. The nature of a complaint is, very often, far more indicative of the absence, or a lack, of service

quality. For example, the fact that 50 clients complained about having to wait for a longer time than they expected to

access gymnasium equipment is insignificant when compared to an accident arising from failure to maintain properly a

piece of gymnasium equipment. Moreover, the marketing director ought to be aware that the absolute number of

complaints may be misleading as much depends on the number of clients serviced during any given period. Thus, in

comparing the number of complaints received by the three centres then a relative measure of complaints received per

1,000 client days would be far more useful than the absolute number of complaints received.

The marketing director should also be advised that the number of complaints can give a misleading picture of the quality

of service provision since individuals have different levels of willingness to complain in similar situations.

The marketing director seems to accept the current level of complaints but is unwilling to accept any increase above this

level. This is not indicative of a quality-oriented organisation which would seek to reduce the number of complaints over

time via a programme of ‘continuous improvement’.

From the foregoing comments one can conclude that it would be myopic to focus on the number of client complaints

as being the only performance measure necessary to measure the quality of service provision. Other performance

measures which may indicate the level of service quality provided to clients by HFG are as follows:

– Staff responsiveness assumes critical significance in service industries. Hence the time taken to resolve client

queries by health centre staff is an important indicator of the level of service quality provided to clients.

– Staff appearance may be viewed as reflecting the image of the centres.

– The comfort of bedrooms and public rooms including facilities such as air-conditioning, tea/coffee-making and cold

drinks facilities, and office facilities such as e-mail, facsimile and photocopying.

– The availability of services such as the time taken to gain an appointment with a dietician or fitness consultant.

– The cleanliness of all areas within the centres will enhance the reputation of HFG. Conversely, unclean areas will

potentially deter clients from making repeat visits and/or recommendations to friends, colleagues etc.

– The presence of safety measures and the frequency of inspections made regarding gymnasium equipment within

the centres and compliance with legislation are of paramount importance in businesses like that of HFG.

– The achievement of target reductions in weight that have been agreed between centre consultants and clients.

(Other relevant measures would be acceptable.)

-

第17题:

(ii) Advise Andrew of the tax implications arising from the disposal of the 7% Government Stock, clearly

identifying the tax year in which any liability will arise and how it will be paid. (3 marks)

正确答案:

(ii) Government stock is an exempt asset for the purposes of capital gains tax, however, as Andrew’s holding has a nominal

value in excess of £5,000, a charge to income tax will arise under the accrued income scheme. This charge to income

tax will arise in 2005/06, being the tax year in which the next interest payment following disposal falls due (20 April

2005) and it will relate to the income accrued for the period 21 October 2004 to 14 March 2005 of £279 (145/182

x £350). As interest on Government Stock is paid gross (unless the holder applies to receive it net), the tax due of £112

(£279 x 40%) will be collected via the self-assessment system and as the interest was an ongoing source of income

will be included within Andrew’s half yearly payments on account payable on 31 January and 31 July 2006. -

第18题:

(iv) The stamp duty and/or stamp duty land tax payable by the Saturn Ltd group; (2 marks)

Additional marks will be awarded for the appropriateness of the format and presentation of the memorandum

and the effectiveness with which the information is communicated. (2 marks)

正确答案:

(iv) Stamp duty and stamp duty land tax

– The purchase of Tethys Ltd will give rise to a liability to ad valorem stamp duty of £1,175 (£235,000 x 0·5%).

The stamp duty must be paid by Saturn Ltd within 30 days of the share transfer in order to avoid interest being

charged. It is not an allowable expense for the purposes of corporation tax. -

第19题:

In relation to the law of contract, distinguish between and explain the effect of:

(a) a term and a mere representation; (3 marks)

(b) express and implied terms, paying particular regard to the circumstances under which terms may be implied in contracts. (7 marks)

正确答案:This question requires candidates to consider the law relating to terms in contracts. It specifically requires the candidates to distinguish between terms and mere representations and then to establish the difference between express and implied terms in contracts.

(a) As the parties to a contract will be bound to perform. any promise they have contracted to undertake, it is important to distinguish between such statements that will be considered part of the contract, i.e. terms, and those other pre-contractual statements which are not considered to be part of the contract, i.e. mere representations. The reason for distinguishing between them is that there are different legal remedies available if either statement turns out to be incorrect.

A representation is a statement that induces a contract but does not become a term of the contract. In practice it is sometimes difficult to distinguish between the two, but in attempting to do so the courts will focus on when the statement was made in relation to the eventual contract, the importance of the statement in relation to the contract and whether or not the party making the statement had specialist knowledge on which the other party relied (Oscar Chess v Williams (1957) and Dick

Bentley v Arnold Smith Motors (1965)).

(b) Express terms are statements actually made by one of the parties with the intention that they become part of the contract and

thus binding and enforceable through court action if necessary. It is this intention that distinguishes the contractual term from

the mere representation, which, although it may induce the contractual agreement, does not become a term of the contract.

Failure to comply with the former gives rise to an action for breach of contract, whilst failure to comply with the latter only gives rise to an action for misrepresentation.Such express statements may be made by word of mouth or in writing as long as they are sufficiently clear for them to be enforceable. Thus in Scammel v Ouston (1941) Ouston had ordered a van from the claimant on the understanding that the balance of the purchase price was to be paid ‘on hire purchase terms over two years’. When Scammel failed to deliver the van Ouston sued for breach of contract without success, the court holding that the supposed terms of the contract were too

uncertain to be enforceable. There was no doubt that Ouston wanted the van on hire purchase but his difficulty was that

Scammel operated a range of hire purchase terms and the precise conditions of his proposed hire purchase agreement were

never sufficiently determined.

Implied terms, however, are not actually stated or expressly included in the contract, but are introduced into the contract by implication. In other words the exact meaning and thus the terms of the contract are inferred from its context. Implied terms can be divided into three types.

Terms implied by statute

In this instance a particular piece of legislation states that certain terms have to be taken as constituting part of an agreement, even where the contractual agreement between the parties is itself silent as to that particular provision. For example, under s.5 of the Partnership Act 1890, every member of an ordinary partnership has the implied power to bind the partnership in a contract within its usual sphere of business. That particular implied power can be removed or reduced by the partnership agreement and any such removal or reduction of authority would be effective as long as the other party was aware of it. Some implied terms, however, are completely prescriptive and cannot be removed.

Terms implied by custom or usage

An agreement may be subject to terms that are customarily found in such contracts within a particular market, trade or locality. Once again this is the case even where it is not actually specified by the parties. For example, in Hutton v Warren (1836), it was held that customary usage permitted a farm tenant to claim an allowance for seed and labour on quitting his tenancy. It should be noted, however, that custom cannot override the express terms of an agreement (Les Affreteurs Reunnis SA v Walford (1919)).

Terms implied by the courts Generally, it is a matter for the parties concerned to decide the terms of a contract, but on occasion the court will presume that the parties intended to include a term which is not expressly stated. They will do so where it is necessary to give business efficacy to the contract.Whether a term may be implied can be decided on the basis of the officious bystander test. Imagine two parties, A and B, negotiating a contract, when a third party, C, interrupts to suggest a particular provision. A and B reply that that particular term is understood. In just such a way, the court will decide that a term should be implied into a contract.

In The Moorcock (1889), the appellants, owners of a wharf, contracted with the respondents to permit them to discharge their ship at the wharf. It was apparent to both parties that when the tide was out the ship would rest on the riverbed. When the tide was out, the ship sustained damage by settling on a ridge. It was held that there was an implied warranty in the contract that the place of anchorage should be safe for the ship. As a consequence, the ship owner was entitled to damages for breach of that term.

Alternatively the courts will imply certain terms into unspecific contracts where the parties have not reduced the general agreement into specific details. Thus in contracts of employment the courts have asserted the existence of implied terms to impose duties on both employers and employees, although such implied terms can be overridden by express contractual provision to the contrary. -

第20题:

(b) Explain the matters that should be considered when planning the nature and scope of the examination of

Cusiter Co’s forecast balance sheet and income statement as prepared for the bank. (7 marks)

正确答案:

(b) Matters to be considered

Tutorial note: Candidates at this level must appreciate that the matters to be considered when planning the nature and

scope of the examination are not the same matters to be considered when deciding whether or not to accept an

engagement. The scenario clearly indicates that the assignment is being undertaken by the current auditor rendering any

‘pre-engagement’/‘professional etiquette’ considerations irrelevant to answering this question.

This PFI has been prepared to show an external user, the bank, the financial consequences of Cusiter’s plans to help the bank

in making an investment decision. If Cusiter is successful in its loan application the PFI provides a management tool against

which the results of investing in the plant and equipment can be measured.

The PFI is unpublished rather than published. That is, it is prepared at the specific request of a third party, the bank. It will

not be published to users of financial information in general.

The auditor’s report on the PFI will provide only negative assurance as to whether the assumptions provide a reasonable basis

for the PFI and an opinion whether the PFI is:

■ properly prepared on the basis of the assumptions; and

■ presented in accordance with the relevant financial reporting framework.

The nature of the engagement is an examination to obtain evidence concerning:

■ the reasonableness and consistency of assumptions made;

■ proper preparation (on the basis of stated assumptions); and

■ consistent presentation (with historical financial statements, using appropriate accounting principles).

Such an examination is likely to take the form. of inquiry, analytical procedures and corroboration.

The period of time covered by the prospective financial information is two years. The assumptions for 2008 are likely to be

more speculative than for 2007, particularly in relation to the impact on earnings, etc of the investment in new plant and

equipment.

The forecast for the year to 31 December 2007 includes an element of historical financial information (because only part of

this period is in the future) hence actual evidence should be available to verify the first three months of the forecast (possibly

more since another three-month period will expire at the end of the month).

Cusiter management’s previous experience in preparing PFI will be relevant. For example, in making accounting estimates

(e.g. for provisions, impairment losses, etc) or preparing cash flow forecasts (e.g. in support of the going concern assertion).

The basis of preparation of the forecast. For example, the extent to which it comprises:

■ proforma financial information (i.e. historical financial information adjusted for the effects of the planned loan and capital

expenditure transaction);

■ new information and assumptions about future performance (e.g. the operating capacity of the new equipment, sales

generated, etc).

The nature and scope of any standards/guidelines under which the PFI has been prepared is likely to assist the auditor in

discharging their responsibilities to report on it. Also, ISAE 3400 The Examination of Prospective Financial Information,

establishes standards and provides guidance on engagements to examine and report on PFI including examination

procedures.

The planned nature and scope of the examination is likely to take into account the time and fee budgets for the assignments

as adjusted for any ‘overlap’ with audit work. For example, the examination of the PFI is likely to draw on the auditor’s

knowledge of the business obtained in auditing the financial statements to 31 December 2006. Analytical procedures carried

out in respect of the PFI may provide evidence relevant to the 31 December 2007 audit. -

第21题:

3 (a) Financial statements often contain material balances recognised at fair value. For auditors, this leads to additional

audit risk.

Required:

Discuss this statement. (7 marks)

正确答案:

3 Poppy Co

(a) Balances held at fair value are frequently recognised as material items in the statement of financial position. Sometimes it is

required by the financial reporting framework that the measurement of an asset or liability is at fair value, e.g. certain

categories of financial instruments, whereas it is sometimes the entity’s choice to measure an item using a fair value model

rather than a cost model, e.g. properties. It is certainly the case that many of these balances will be material, meaning that

the auditor must obtain sufficient appropriate evidence that the fair value measurement is in accordance with the

requirements of financial reporting standards. ISA 540 (Revised and Redrafted) Auditing Accounting Estimates Including Fair

Value Accounting Estimates and Related Disclosures and ISA 545 Auditing Fair Value Measurements and Disclosures

contain guidance in this area.

As part of the understanding of the entity and its environment, the auditor should gain an insight into balances that are stated

at fair value, and then assess the impact of this on the audit strategy. This will include an evaluation of the risk associated

with the balance(s) recognised at fair value.

Audit risk comprises three elements; each is discussed below in the context of whether material balances shown at fair value

will lead to increased risk for the auditor.

Inherent risk

Many measurements based on estimates, including fair value measurements, are inherently imprecise and subjective in

nature. The fair value assessment is likely to involve significant judgments, e.g. regarding market conditions, the timing of

cash flows, or the future intentions of the entity. In addition, there may be a deliberate attempt by management to manipulate

the fair value to achieve a desired aim within the financial statements, in other words to attempt some kind of window

dressing.

Many fair value estimation models are complicated, e.g. discounted cash flow techniques, or the actuarial calculations used

to determine the value of a pension fund. Any complicated calculations are relatively high risk, as difficult valuation techniques

are simply more likely to contain errors than simple valuation techniques. However, there will be some items shown at fair

value which have a low inherent risk, because the measurement of fair value may be relatively straightforward, e.g. assets

that are regularly bought and sold on open markets that provide readily available and reliable information on the market prices

at which actual exchanges occur.

In addition to the complexities discussed above, some fair value measurement techniques will contain significant

assumptions, e.g. the most appropriate discount factor to use, or judgments over the future use of an asset. Management

may not always have sufficient experience and knowledge in making these judgments.

Thus the auditor should approach some balances recognised at fair value as having a relatively high inherent risk, as their

subjective and complex nature means that the balance is prone to contain an error. However, the auditor should not just

assume that all fair value items contain high inherent risk – each balance recognised at fair value should be assessed for its

individual level of risk.

Control risk

The risk that the entity’s internal monitoring system fails to prevent and detect valuation errors needs to be assessed as part

of overall audit risk assessment. One problem is that the fair value assessment is likely to be performed once a year, outside

the normal accounting and management systems, especially where the valuation is performed by an external specialist.

Therefore, as a non-routine event, the assessment of fair value is likely not to have the same level of monitoring or controls

as a day-to-day business transaction.

However, due to the material impact of fair values on the statement of financial position, and in some circumstances on profit,

management may have made great effort to ensure that the assessment is highly monitored and controlled. It therefore could

be the case that there is extremely low control risk associated with the recognition of fair values.

Detection risk

The auditor should minimise detection risk via thorough planning and execution of audit procedures. The audit team may

lack experience in dealing with the fair value in question, and so would be unlikely to detect errors in the valuation techniques

used. Over-reliance on an external specialist could also lead to errors not being found.

Conclusion

It is true that the increasing recognition of items measured at fair value will in many cases cause the auditor to assess the

audit risk associated with the balance as high. However, it should not be assumed that every fair value item will be likely to

contain a material misstatement. The auditor must be careful to identify and respond to the level of risk for fair value items

on an individual basis to ensure that sufficient and appropriate evidence is gathered, thus reducing the audit risk to an

acceptable level. -

第22题:

(b) (i) Explain the matters you should consider, and the evidence you would expect to find in respect of the

carrying value of the cost of investment of Dylan Co in the financial statements of Rosie Co; and

(7 marks)

正确答案:

(b) (i) Cost of investment on acquisition of Dylan Co

Matters to consider

According to the schedule provided by the client, the cost of investment comprises three elements. One matter to

consider is whether the cost of investment is complete.

It appears that no legal or professional fees have been included in the cost of investment (unless included within the

heading ‘cash consideration’). Directly attributable costs should be included per IFRS 3 Business Combinations, and

there is a risk that these costs may be expensed in error, leading to understatement of the investment.

The cash consideration of $2·5 million is the least problematical component. The only matter to consider is whether the

cash has actually been paid. Given that Dylan Co was acquired in the last month of the financial year it is possible that

the amount had not been paid before the year end, in which case the amount should be recognised as a current liability

on the statement of financial position (balance sheet). However, this seems unlikely given that normally control of an

acquired company only passes to the acquirer on cash payment.

IFRS 3 states that the cost of investment should be recognised at fair value, which means that deferred consideration

should be discounted to present value at the date of acquisition. If the consideration payable on 31 January 2009 has

not been discounted, the cost of investment, and the corresponding liability, will be overstated. It is possible that the

impact of discounting the $1·5 million payable one year after acquisition would be immaterial to the financial

statements, in which case it would be acceptable to leave the consideration at face value within the cost of investment.

Contingent consideration should be accrued if it is probable to be paid. Here the amount is payable if revenue growth

targets are achieved over the next four years. The auditor must therefore assess the probability of the targets being

achieved, using forecasts and projections of Maxwell Co’s revenue. Such information is inherently subjective, and could

have been manipulated, if prepared by the vendor of Maxwell Co, in order to secure the deal and maximise

consideration. Here it will be crucial to be sceptical when reviewing the forecasts, and the assumptions underlying the

data. The management of Rosie Co should have reached their own opinion on the probability of paying the contingent

consideration, but they may have relied heavily on information provided at the time of the acquisition.

Audit evidence

– Agreement of the monetary value and payment dates of the consideration per the client schedule to legal

documentation signed by vendor and acquirer.

– Agreement of $2·5 million paid to Rosie Co’s bank statement and cash book prior to year end. If payment occurs

after year end confirm that a current liability is recognised on the individual company and consolidated statement

of financial position (balance sheet).

– Board minutes approving the payment.

– Recomputation of discounting calculations applied to deferred and contingent consideration.

– Agreement that the discount rate used is pre-tax, and reflects current market assessment of the time value of money

(e.g. by comparison to Rosie Co’s weighted average cost of capital).

– Revenue and profit projections for the period until January 2012, checked for arithmetic accuracy.

– A review of assumptions used in the projections, and agreement that the assumptions are comparable with the

auditor’s understanding of Dylan Co’s business.

Tutorial note: As the scenario states that Chien & Co has audited Dylan Co for several years, it is reasonable to rely on

their cumulative knowledge and understanding of the business in auditing the revenue projections. -

第23题:

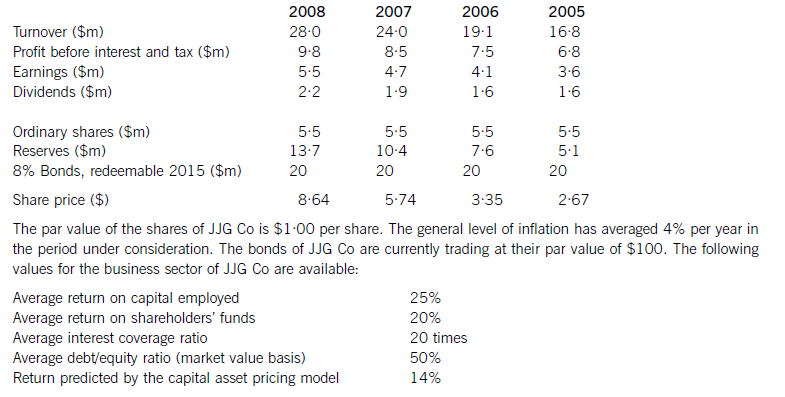

JJG Co is planning to raise $15 million of new finance for a major expansion of existing business and is considering a rights issue, a placing or an issue of bonds. The corporate objectives of JJG Co, as stated in its Annual Report, are to maximise the wealth of its shareholders and to achieve continuous growth in earnings per share. Recent financial information on JJG Co is as follows:

Required:

(a) Evaluate the financial performance of JJG Co, and analyse and discuss the extent to which the company has achieved its stated corporate objectives of:

(i) maximising the wealth of its shareholders;

(ii) achieving continuous growth in earnings per share.

Note: up to 7 marks are available for financial analysis.(12 marks)

(b) If the new finance is raised via a rights issue at $7·50 per share and the major expansion of business has

not yet begun, calculate and comment on the effect of the rights issue on:

(i) the share price of JJG Co;

(ii) the earnings per share of the company; and

(iii) the debt/equity ratio. (6 marks)

(c) Analyse and discuss the relative merits of a rights issue, a placing and an issue of bonds as ways of raising the finance for the expansion. (7 marks)

正确答案:

AchievementofcorporateobjectivesJJGCohasshareholderwealthmaximisationasanobjective.Thewealthofshareholdersisincreasedbydividendsreceivedandcapitalgainsonsharesowned.Totalshareholderreturncomparesthesumofthedividendreceivedandthecapitalgainwiththeopeningshareprice.TheshareholdersofJJGCohadareturnof58%in2008,comparedwithareturnpredictedbythecapitalassetpricingmodelof14%.Thelowestreturnshareholdershavereceivedwas21%andthehighestreturnwas82%.Onthisbasis,theshareholdersofthecompanyhaveexperiencedasignificantincreaseinwealth.Itisdebatablewhetherthishasbeenasaresultoftheactionsofthecompany,however.Sharepricesmayincreaseirrespectiveoftheactionsanddecisionsofmanagers,orevendespitethem.Infact,lookingatthedividendpersharehistoryofthecompany,therewasoneyear(2006)wheredividendswereconstant,eventhoughearningspershareincreased.Itisalsodifficulttoknowwhenwealthhasbeenmaximised.Anotherobjectiveofthecompanywastoachieveacontinuousincreaseinearningspershare.Analysisshowsthatearningspershareincreasedeveryyear,withanaverageincreaseof14·9%.Thisobjectiveappearstohavebeenachieved.CommentonfinancialperformanceReturnoncapitalemployed(ROCE)hasbeengrowingtowardsthesectoraverageof25%onayear-by-yearbasisfrom22%in2005.Thissteadygrowthintheprimaryaccountingratiocanbecontrastedwithirregulargrowthinturnover,thereasonsforwhichareunknown.Returnonshareholders’fundshasbeenconsistentlyhigherthantheaverageforthesector.ThismaybeduemoretothecapitalstructureofJJGCothantogoodperformancebythecompany,however,inthesensethatshareholders’fundsaresmalleronabookvaluebasisthanthelong-termdebtcapital.Ineverypreviousyearbut2008thegearingofthecompanywashigherthanthesectoraverage.(b)CalculationoftheoreticalexrightspershareCurrentshareprice=$8·64pershareCurrentnumberofshares=5·5millionsharesFinancetoberaised=$15mRightsissueprice=$7·50pershareNumberofsharesissued=15m/7·50=2millionsharesTheoreticalexrightspricepershare=((5·5mx8·64)+(2mx7·50))/7·5m=$8·34pershareThesharepricewouldfallfrom$8·64to$8·34pershareHowever,therewouldbenoeffectonshareholderwealthEffectofrightsissueonearningspershareCurrentEPS=100centspershareRevisedEPS=100x5·5m/7·5m=73centspershareTheEPSwouldfallfrom100centspershareto73centspershareHowever,asmentionedearlier,therewouldbenoeffectonshareholderwealthEffectofrightsissueonthedebt/equityratioCurrentdebt/equityratio=100x20/47·5=42%Revisedmarketvalueofequity=7·5mx8·34=$62·55millionReviseddebt/equityratio=100x20/62·55=32%Thedebt/equityratiowouldfallfrom42%to32%,whichiswellbelowthesectoraveragevalueandwouldsignalareductioninfinancialrisk(c)Thecurrentdebt/equityratioofJJGCois42%(20/47·5).Althoughthisislessthanthesectoraveragevalueof50%,itismoreusefulfromafinancialriskperspectivetolookattheextenttowhichinterestpaymentsarecoveredbyprofits.Theinterestonthebondissueis$1·6million(8%of$20m),givinganinterestcoverageratioof6·1times.IfJJGCohasoverdraftfinance,theinterestcoverageratiowillbelowerthanthis,butthereisinsufficientinformationtodetermineifanoverdraftexists.Theinterestcoverageratioisnotonlybelowthesectoraverage,itisalsolowenoughtobeacauseforconcern.Whiletheratioshowsanupwardtrendovertheperiodunderconsideration,itstillindicatesthatanissueoffurtherdebtwouldbeunwise.Aplacing,oranyissueofnewsharessuchasarightsissueorapublicoffer,woulddecreasegearing.Iftheexpansionofbusinessresultsinanincreaseinprofitbeforeinterestandtax,theinterestcoverageratiowillincreaseandfinancialriskwillfall.GiventhecurrentfinancialpositionofJJGCo,adecreaseinfinancialriskiscertainlypreferabletoanincrease.Aplacingwilldiluteownershipandcontrol,providingthenewequityissueistakenupbynewinstitutionalshareholders,whilearightsissuewillnotdiluteownershipandcontrol,providingexistingshareholderstakeuptheirrights.Abondissuedoesnothaveownershipandcontrolimplications,althoughrestrictiveornegativecovenantsinbondissuedocumentscanlimittheactionsofacompanyanditsmanagers.Allthreefinancingchoicesarelong-termsourcesoffinanceandsoareappropriateforalong-terminvestmentsuchastheproposedexpansionofexistingbusiness.Equityissuessuchasaplacingandarightsissuedonotrequiresecurity.Noinformationisprovidedonthenon-currentassetsofJJGCo,butitislikelythattheexistingbondissueissecured.Ifanewbondissuewasbeingconsidered,JJGCowouldneedtoconsiderwhetherithadsufficientnon-currentassetstoofferassecurity,althoughitislikelythatnewnon-currentassetswouldbeboughtaspartofthebusinessexpansion.