22 Which of the following items may appear in a company’s statement of changes in equity, according to IAS 1 Presentation of financial statements?1 Unrealised revaluation gains.2 Dividends paid.3 Proceeds of equity share issue.4 Profit for the period.A 2,

题目

22 Which of the following items may appear in a company’s statement of changes in equity, according to IAS 1 Presentation of financial statements?

1 Unrealised revaluation gains.

2 Dividends paid.

3 Proceeds of equity share issue.

4 Profit for the period.

A 2, 3 and 4 only

B 1, 3 and 4 only

C All four items

D 1, 2 and 4 only

相似考题

更多“22 Which of the following items may appear in a company’s statement of changes in equity, according to IAS 1 Presentation of financial statements?1 Unrealised revaluation gains.2 Dividends paid.3 Proceeds of equity share issue.4 Profit for the period.A 2,”相关问题

-

第1题:

16 Which of the following events between the balance sheet date and the date the financial statements are

authorised for issue must be adjusted in the financial statements?

1 Declaration of equity dividends.

2 Decline in market value of investments.

3 The announcement of changes in tax rates.

4 The announcement of a major restructuring.

A 1

A 1 only

B 2 and 4

C 3 only

D None of them

正确答案:D

-

第2题:

3 The directors of Panel, a public limited company, are reviewing the procedures for the calculation of the deferred tax

provision for their company. They are quite surprised at the impact on the provision caused by changes in accounting

standards such as IFRS1 ‘First time adoption of International Financial Reporting Standards’ and IFRS2 ‘Share-based

Payment’. Panel is adopting International Financial Reporting Standards for the first time as at 31 October 2005 and

the directors are unsure how the deferred tax provision will be calculated in its financial statements ended on that

date including the opening provision at 1 November 2003.

Required:

(a) (i) Explain how changes in accounting standards are likely to have an impact on the provision for deferred

taxation under IAS12 ‘Income Taxes’. (5 marks)

正确答案:(a) (i) IAS12 ‘Income Taxes’ adopts a balance sheet approach to accounting for deferred taxation. The IAS adopts a full

provision approach to accounting for deferred taxation. It is assumed that the recovery of all assets and the settlement

of all liabilities have tax consequences and that these consequences can be estimated reliably and are unavoidable.

IFRS recognition criteria are generally different from those embodied in tax law, and thus ‘temporary’ differences will

arise which represent the difference between the carrying amount of an asset and liability and its basis for taxation

purposes (tax base). The principle is that a company will settle its liabilities and recover its assets over time and at that

point the tax consequences will crystallise.Thus a change in an accounting standard will often affect the carrying value of an asset or liability which in turn will

affect the amount of the temporary difference between the carrying value and the tax base. This in turn will affect the

amount of the deferred taxation provision which is the tax rate multiplied by the amount of the temporary differences(assuming a net liability for deferred tax.) -

第3题:

(c) Wader is reviewing the accounting treatment of its buildings. The company uses the ‘revaluation model’ for its

buildings. The buildings had originally cost $10 million on 1 June 2005 and had a useful economic life of

20 years. They are being depreciated on a straight line basis to a nil residual value. The buildings were revalued

downwards on 31 May 2006 to $8 million which was the buildings’ recoverable amount. At 31 May 2007 the

value of the buildings had risen to $11 million which is to be included in the financial statements. The company

is unsure how to treat the above events. (7 marks)

Required:

Discuss the accounting treatments of the above items in the financial statements for the year ended 31 May

2007.

Note: a discount rate of 5% should be used where necessary. Candidates should show suitable calculations where

necessary.

正确答案:

-

第4题:

9 Which of the following items must be disclosed in a company’s published financial statements (including notes)

if material, according to IAS1 Presentation of financial statements?

1 Finance costs.

2 Staff costs.

3 Depreciation and amortisation expense.

4 Movements on share capital.

A 1 and 3 only

B 1, 2 and 4 only

C 2, 3 and 4 only

D All four items

正确答案:D

-

第5题:

22 Which of the following statements about limited liability companies’ accounting is/are correct?

1 A revaluation reserve arises when a non-current asset is sold at a profit.

2 The authorised share capital of a company is the maximum nominal value of shares and loan notes the company

may issue.

3 The notes to the financial statements must contain details of all adjusting events as defined in IAS10 Events after

the balance sheet date.

A All three statements

B 1 and 2 only

C 2 and 3 only

D None of the statements

正确答案:D

-

第6题:

The following information is relevant for questions 9 and 10

A company’s draft financial statements for 2005 showed a profit of $630,000. However, the trial balance did not agree,

and a suspense account appeared in the company’s draft balance sheet.

Subsequent checking revealed the following errors:

(1) The cost of an item of plant $48,000 had been entered in the cash book and in the plant account as $4,800.

Depreciation at the rate of 10% per year ($480) had been charged.

(2) Bank charges of $440 appeared in the bank statement in December 2005 but had not been entered in the

company’s records.

(3) One of the directors of the company paid $800 due to a supplier in the company’s payables ledger by a personal

cheque. The bookkeeper recorded a debit in the supplier’s ledger account but did not complete the double entry

for the transaction. (The company does not maintain a payables ledger control account).

(4) The payments side of the cash book had been understated by $10,000.

9 Which of the above items would require an entry to the suspense account in correcting them?

A All four items

B 3 and 4 only

C 2 and 3 only

D 1, 2 and 4 only

正确答案:B

-

第7题:

17 Which of the following statements are correct?

(1) All non-current assets must be depreciated.

(2) If goodwill is revalued, the revaluation surplus appears in the statement of changes in equity.

(3) If a tangible non-current asset is revalued, all tangible assets of the same class should be revalued.

(4) In a company’s published balance sheet, tangible assets and intangible assets must be shown separately.

A 1 and 2

B 2 and 3

C 3 and 4

D 1 and 4

正确答案:C

-

第8题:

(b) You are an audit manager with specific responsibility for reviewing other information in documents containing

audited financial statements before your firm’s auditor’s report is signed. The financial statements of Hegas, a

privately-owned civil engineering company, show total assets of $120 million, revenue of $261 million, and profit

before tax of $9·2 million for the year ended 31 March 2005. Your review of the Annual Report has revealed

the following:

(i) The statement of changes in equity includes $4·5 million under a separate heading of ‘miscellaneous item’

which is described as ‘other difference not recognized in income’. There is no further reference to this

amount or ‘other difference’ elsewhere in the financial statements. However, the Management Report, which

is required by statute, is not audited. It discloses that ‘changes in shareholders’ equity not recognized in

income includes $4·5 million arising on the revaluation of investment properties’.

The notes to the financial statements state that the company has implemented IAS 40 ‘Investment Property’

for the first time in the year to 31 March 2005 and also that ‘the adoption of this standard did not have a

significant impact on Hegas’s financial position or its results of operations during 2005’.

(ii) The chairman’s statement asserts ‘Hegas has now achieved a position as one of the world’s largest

generators of hydro-electricity, with a dedicated commitment to accountable ethical professionalism’. Audit

working papers show that 14% of revenue was derived from hydro-electricity (2004: 12%). Publicly

available information shows that there are seven international suppliers of hydro-electricity in Africa alone,

which are all at least three times the size of Hegas in terms of both annual turnover and population supplied.

Required:

Identify and comment on the implications of the above matters for the auditor’s report on the financial

statements of Hegas for the year ended 31 March 2005. (10 marks)

正确答案:

(b) Implications for the auditor’s report

(i) Management Report

■ $4·5 million represents 3·75% of total assets, 1·7% of revenue and 48·9% profit before tax. As this is material

by any criteria (exceeding all of 2% of total assets, 1/2% revenue and 5% PBT), the specific disclosure requirements

of IASs need to be met (IAS 1 ‘Presentation of Financial Statements’).

■ The Management Report discloses the amount and the reason for a material change in equity whereas the financial

statements do not show the reason for the change and suggest that it is immaterial. As the increase in equity

attributable to this adjustment is nearly half as much as that attributable to PBT there is a material inconsistency

between the Management Report and the audited financial statements.

■ Amendment to the Management Report is not required.

Tutorial note: Marks will be awarded for arguing, alternatively, that the Management Report disclosure needs to

be amended to clarify that the revaluation arises from the first time implementation.

■ Amendment to the financial statements is required because the disclosure is:

– incorrect – as, on first adoption of IAS 40, the fair value adjustment should be against the opening balance

of retained earnings; and

– inadequate – because it is being ‘supplemented’ by additional disclosure in a document which is not within

the scope of the audit of financial statements.

■ Whilst it is true that the adoption of IAS 40 did not have a significant impact on results of operations, Hegas’s

financial position has increased by nearly 4% in respect of the revaluation (to fair value) of just one asset category

(investment properties). As this is significant, the statement in the notes should be redrafted.

■ If the financial statements are not amended, the auditor’s report should be qualified ‘except for’ on grounds of

disagreement (non-compliance with IAS 40) as the matter is material but not pervasive. Additional disclosure

should also be given (e.g. that the ‘other difference’ is a fair value adjustment).

■ However, it is likely that when faced with the prospect of a qualified auditor’s report Hegas’s management will

rectify the financial statements so that an unmodified auditor’s report can be issued.

Tutorial note: Marks will be awarded for other relevant points e.g. citing IAS 8 ‘Accounting Policies, Changes in

Accounting Estimates and Errors’.

(ii) Chairman’s statement

Tutorial note: Hegas is privately-owned therefore IAS 14 ‘Segment Reporting’ does not apply and the proportion of

revenue attributable to hydro-electricity will not be required to be disclosed in the financial statements. However, credit

will be awarded for discussing the implications for the auditor’s report if it is regarded as a material inconsistency on

the assumption that segment revenue (or similar) is reported in the financial statements.

■ The assertion in the chairman’s statement, which does not fall within the scope of the audit of the financial

statements, claims two things, namely that the company:

(1) is ‘one of the world’s largest generators of hydro-electricity’; and

(2) has ‘a dedicated commitment to accountable ethical professionalism’.

■ To the extent that this information does not relate to matters disclosed in the financial statements it may give rise

to a material misstatement of fact. In particular, the first statement presents a misleading impression of the

company’s size. In misleading a user of the financial statements with this statement, the second statement is not

true (as it is not ethical or professional to mislead the reader and potentially undermine the credibility of the

financial statements).

■ The first statement is a material misstatement of fact because, for example:

– the company is privately-owned, and publicly-owned international/multi-nationals are larger;

– the company’s main activity is civil engineering not electricity generation (only 14% of revenue is derived from

HEP);

– as the company ranks at best eighth against African companies alone it ranks much lower globally.

■ Hegas should be asked to reconsider the wording of the chairman’s statement (i.e. removing these assertions) and

consult, as necessary, the company’s legal advisor.

■ If the statement is not changed there will be no grounds for qualification of the opinion on the audited financial

statements. The audit firm should therefore take legal advice on how the matter should be reported.

■ However, an emphasis of matter paragraph may be used to report on matters other than those affecting the audited

financial statements. For example, to explain the misstatement of fact if management refuses to make the

amendment.

Tutorial note: Marks will also be awarded for relevant comments about the chairman’s statement being perceived by

many readers to be subject to audit and therefore that the unfounded statement might undermine the credibility of the

financial statements. Shareholders tend to rely on the chairman’s statement, even though it is not regulated or audited,

because modern financial statements are so complex. -

第9题:

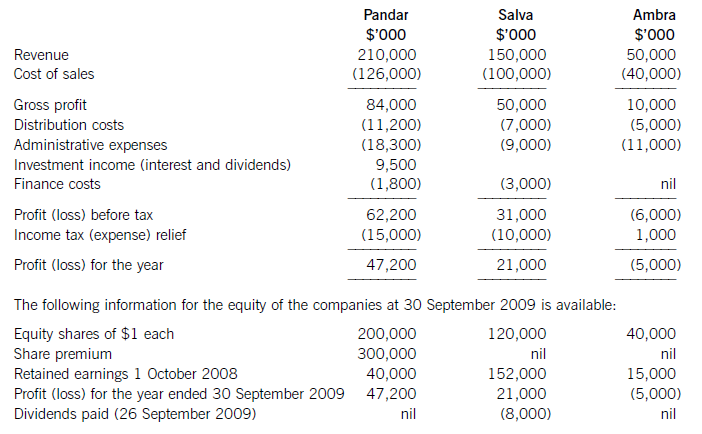

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

正确答案:

-

第10题:

(a) The following figures have been calculated from the financial statements (including comparatives) of Barstead for

the year ended 30 September 2009:

increase in profit after taxation 80%

increase in (basic) earnings per share 5%

increase in diluted earnings per share 2%

Required:

Explain why the three measures of earnings (profit) growth for the same company over the same period can

give apparently differing impressions. (4 marks)

(b) The profit after tax for Barstead for the year ended 30 September 2009 was $15 million. At 1 October 2008 the company had in issue 36 million equity shares and a $10 million 8% convertible loan note. The loan note will mature in 2010 and will be redeemed at par or converted to equity shares on the basis of 25 shares for each $100 of loan note at the loan-note holders’ option. On 1 January 2009 Barstead made a fully subscribed rights issue of one new share for every four shares held at a price of $2·80 each. The market price of the equity shares of Barstead immediately before the issue was $3·80. The earnings per share (EPS) reported for the year ended 30 September 2008 was 35 cents.

Barstead’s income tax rate is 25%.

Required:

Calculate the (basic) EPS figure for Barstead (including comparatives) and the diluted EPS (comparatives not required) that would be disclosed for the year ended 30 September 2009. (6 marks)

正确答案:

(a)Whilstprofitaftertax(anditsgrowth)isausefulmeasure,itmaynotgiveafairrepresentationofthetrueunderlyingearningsperformance.Inthisexample,userscouldinterpretthelargeannualincreaseinprofitaftertaxof80%asbeingindicativeofanunderlyingimprovementinprofitability(ratherthanwhatitreallyis:anincreaseinabsoluteprofit).Itispossible,evenprobable,that(someof)theprofitgrowthhasbeenachievedthroughtheacquisitionofothercompanies(acquisitivegrowth).Wherecompaniesareacquiredfromtheproceedsofanewissueofshares,orwheretheyhavebeenacquiredthroughshareexchanges,thiswillresultinagreaternumberofequitysharesoftheacquiringcompanybeinginissue.ThisiswhatappearstohavehappenedinthecaseofBarsteadastheimprovementindicatedbyitsearningspershare(EPS)isonly5%perannum.ThisexplainswhytheEPS(andthetrendofEPS)isconsideredamorereliableindicatorofperformancebecausetheadditionalprofitswhichcouldbeexpectedfromthegreaterresources(proceedsfromthesharesissued)ismatchedwiththeincreaseinthenumberofshares.Simplylookingatthegrowthinacompany’sprofitaftertaxdoesnottakeintoaccountanyincreasesintheresourcesusedtoearnthem.Anyincreaseingrowthfinancedbyborrowings(debt)wouldnothavethesameimpactonprofit(asbeingfinancedbyequityshares)becausethefinancecostsofthedebtwouldacttoreduceprofit.ThecalculationofadilutedEPStakesintoaccountanypotentialequitysharesinissue.Potentialordinarysharesarisefromfinancialinstruments(e.g.convertibleloannotesandoptions)thatmayentitletheirholderstoequitysharesinthefuture.ThedilutedEPSisusefulasitalertsexistingshareholderstothefactthatfutureEPSmaybereducedasaresultofsharecapitalchanges;inasenseitisawarningsign.InthiscasethelowerincreaseinthedilutedEPSisevidencethatthe(higher)increaseinthebasicEPShas,inpart,beenachievedthroughtheincreaseduseofdilutingfinancialinstruments.Thefinancecostoftheseinstrumentsislessthantheearningstheirproceedshavegeneratedleadingtoanincreaseincurrentprofits(andbasicEPS);however,inthefuturetheywillcausemoresharestobeissued.ThiscausesadilutionwherethefinancecostperpotentialnewshareislessthanthebasicEPS. -

第11题:

Under certain circumstances, profits made on transactions between members of a group need to be eliminated from the consolidated financial statements under IFRS.

Which of the following statements about intra-group profits in consolidated financial statements is/are correct?

(i) The profit made by a parent on the sale of goods to a subsidiary is only realised when the subsidiary sells the goods to a third party

(ii) Eliminating intra-group unrealised profits never affects non-controlling interests

(iii) The profit element of goods supplied by the parent to an associate and held in year-end inventory must be eliminated in full

A.(i) only

B.(i) and (ii)

C.(ii) and (iii)

D.(iii) only

正确答案:A(i) is the only correct elimination required by IFRS.

-

第12题:

名词解释题股东权益变动表(Consolidated Statement of Changes in Shareholders’Equity)CSCSE正确答案: 是反映企业在某一特定日期股东权益增减变动情况的报表。股东权益增减变动表包括在年度会计报表中,是资产负债表的附表。解析: 暂无解析 -

第13题:

(b) Assuming that the cost of equity and cost of debt do not alter, estimate the effect of the share repurchase on the company’s cost of capital and value. (5 marks)

正确答案:(b) Estimated new cost of capital:

If equity is repurchased such that the gearing becomes 50% equity, 50% debt, the new estimated weighted average cost of capital is:

-

第14题:

5 Ambush, a public limited company, is assessing the impact of implementing the revised IAS39 ‘Financial Instruments:

Recognition and Measurement’. The directors realise that significant changes may occur in their accounting treatment

of financial instruments and they understand that on initial recognition any financial asset or liability can be

designated as one to be measured at fair value through profit or loss (the fair value option). However, there are certain

issues that they wish to have explained and these are set out below.

Required:

(a) Outline in a report to the directors of Ambush the following information:

(i) how financial assets and liabilities are measured and classified, briefly setting out the accounting

method used for each category. (Hedging relationships can be ignored.) (10 marks)

正确答案:5 Report to the Directors of Ambush, a public limited company

(a) The following report sets out the principal aspects of IAS 39 in the designated areas.

(i) Classification of financial instruments and their measurement

Financial assets and liabilities are initially measured at fair value which will normally be the fair value of the

consideration given or received. Transaction costs are included in the initial carrying value of the instrument unless it

is carried at ‘fair value through profit or loss’ when these costs are recognised in the income statement.

Financial assets should be classified into four categories:

(i) financial assets at fair value through profit or loss

(ii) loans and receivables

(iii) held-to-maturity investments (HTM)

(iv) available-for-sale financial assets (AFS).

The first category above has two sub categories which are ‘held for trading’ and those designated to this category at

inception/initial recognition. This latter designation is irrevocable.

Financial liabilities have two categories: those at fair value through profit or loss, and ‘other’ liabilities. As with financial

assets those liabilities designated as at fair value through profit or loss have two sub categories which are the same as

those for financial assets.

Reclassifications between categories are uncommon and restricted under IAS 39 and are prohibited into and out of the

fair value through profit or loss category. Reclassifications between AFS and HTM are possible but it is not possible from

loans and receivables to AFS. The held to maturity category is limited in its application as if the company sells or

reclassifies more than an immaterial amount of the portfolio, it is barred from using the category for at least two years.

Also all remaining HTM investments would be reclassified to AFS.

Subsequent measurement of financial assets and liabilities depends on the classification. The following tablesummarises the position:

Amortised cost is the cost of an asset or liability adjusted to achieve a constant effective interest rate over the life of the

asset or liability.

It is not possible to compute amortised cost for instruments that do not have fixed or determinable payments, such as

for equity instruments, and such instruments therefore cannot be classified into these categories.

A company must apply the effective interest rate method in the measurement of amortised cost. The effective interest

rate method determines how much interest income or interest expense should be reported in profit and loss.

For financial assets at fair value through profit or loss and financial liabilities at fair value through profit or loss, all

changes in fair value are recognised in profit or loss when they occur. This includes unrealised holding gains and losses.

For available-for-sale financial assets, unrealised holding gains and losses are deferred in reserves until they are realised

or impairment occurs. Only interest income and dividend income, impairment losses, and certain foreign currency gains

and losses are recognised in profit or loss.

Investments in unquoted equity instruments that cannot be reliably measured at fair value are subsequently measureat cost. Unrealised holding gains/losses are not normally recognised in profit/loss. -

第15题:

5 An enterprise has made a material change to an accounting policy in preparing its current financial statements.

Which of the following disclosures are required by IAS 8 Accounting policies, changes in accounting estimates

and errors in these financial statements?

1 The reasons for the change.

2 The amount of the consequent adjustment in the current period and in comparative information for prior periods.

3 An estimate of the effect of the change on future periods, where possible.

A 1 and 2 only

B 1 and 3 only

C 2 and 3 only

D All three items

正确答案:A

-

第16题:

19 Which of the following statements about intangible assets in company financial statements are correct according

to international accounting standards?

1 Internally generated goodwill should not be capitalised.

2 Purchased goodwill should normally be amortised through the income statement.

3 Development expenditure must be capitalised if certain conditions are met.

A 1 and 3 only

B 1 and 2 only

C 2 and 3 only

D All three statements are correct

正确答案:A

-

第17题:

4 (a) A company may choose to finance its activities mainly by equity capital, with low borrowings (low gearing) or by

relying on high borrowings with relatively low equity capital (high gearing).

Required:

Explain why a highly geared company is generally more risky from an investor’s point of view than a company

with low gearing. (3 marks)

正确答案:

(a) A highly-geared company has an obligation to pay interest on its loans regardless of its profit level. It will show high profits if

its overall rate of return on capital is greater than the rate of interest being paid on its borrowings, but a low profit or a loss if

there is a down-turn in its profit such that the rate of interest to be paid exceeds the return on its assets. -

第18题:

11 Which of the following statements are correct?

1 A company might make a rights issue if it wished to raise more equity capital.

2 A rights issue might increase the share premium account whereas a bonus issue is likely to reduce it.

3 A bonus issue will reduce the gearing (leverage) ratio of a company.

4 A rights issue will always increase the number of shareholders in a company whereas a bonus issue will not.

A 1 and 2

B 1 and 3

C 2 and 3

D 2 and 4

正确答案:A

-

第19题:

21 Which of the following items must be disclosed in a company’s published financial statements?

1 Authorised share capital

2 Movements in reserves

3 Finance costs

4 Movements in non-current assets

A 1, 2 and 3 only

B 1, 2 and 4 only

C 2, 3 and 4 only

D All four items

正确答案:D

-

第20题:

听力原文:M: Can you tell me something about a balance sheet?

W: Yes. It is divided into three sections: assets, liabilities, and owner's equity and it is used to summarize a company's financial position on a given date.

Q: Which of the following is not a section of a balance sheet?

(15)

A.Profit and Joss

B.Owner's equity.

C.Liabilities

D.Assets.

正确答案:A

解析:根据女士回答资产负债表分为三部分,即"assets", "liabilities" 和"owner's equity",A项未提及。 -

第21题:

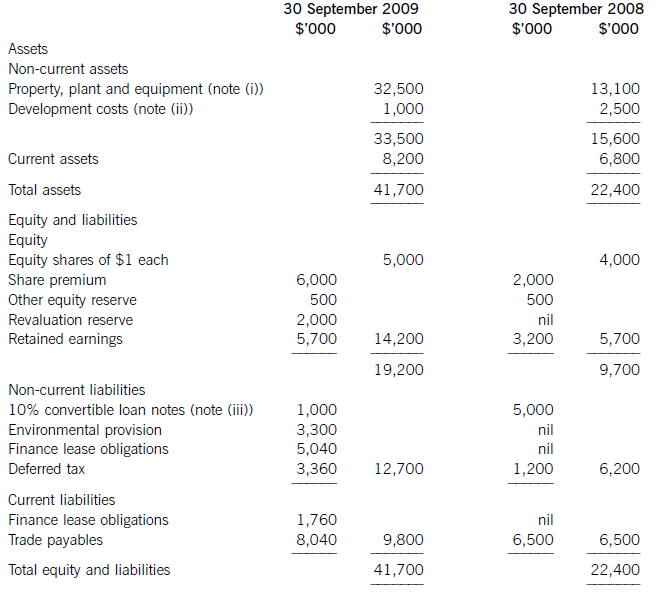

(a) The following information relates to Crosswire a publicly listed company.

Summarised statements of financial position as at:

The following information is available:

(i) During the year to 30 September 2009, Crosswire embarked on a replacement and expansion programme for its non-current assets. The details of this programme are:

On 1 October 2008 Crosswire acquired a platinum mine at a cost of $5 million. A condition of mining the

platinum is a requirement to landscape the mining site at the end of its estimated life of ten years. The

present value of this cost at the date of the purchase was calculated at $3 million (in addition to the

purchase price of the mine of $5 million).

Also on 1 October 2008 Crosswire revalued its freehold land for the first time. The credit in the revaluation

reserve is the net amount of the revaluation after a transfer to deferred tax on the gain. The tax rate applicable to Crosswire for deferred tax is 20% per annum.

On 1 April 2009 Crosswire took out a finance lease for some new plant. The fair value of the plant was

$10 million. The lease agreement provided for an initial payment on 1 April 2009 of $2·4 million followed

by eight six-monthly payments of $1·2 million commencing 30 September 2009.

Plant disposed of during the year had a carrying amount of $500,000 and was sold for $1·2 million. The

remaining movement on the property, plant and equipment, after charging depreciation of $3 million, was

the cost of replacing plant.

(ii) From 1 October 2008 to 31 March 2009 a further $500,000 was spent completing the development

project at which date marketing and production started. The sales of the new product proved disappointing

and on 30 September 2009 the development costs were written down to $1 million via an impairment

charge.

(iii) During the year ended 30 September 2009, $4 million of the 10% convertible loan notes matured. The

loan note holders had the option of redemption at par in cash or to exchange them for equity shares on the

basis of 20 new shares for each $100 of loan notes. 75% of the loan-note holders chose the equity option.

Ignore any effect of this on the other equity reserve.

All the above items have been treated correctly according to International Financial Reporting Standards.

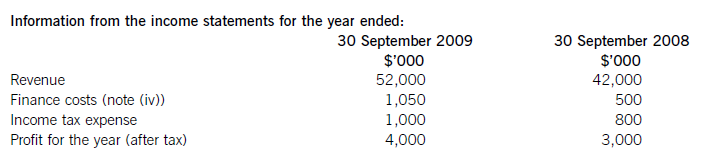

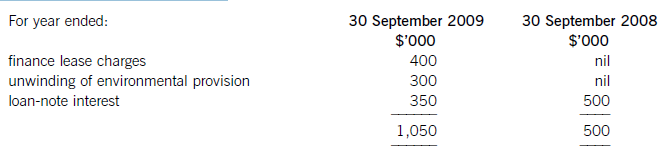

(iv) The finance costs are made up of:

Required:

(i) Prepare a statement of the movements in the carrying amount of Crosswire’s non-current assets for the

year ended 30 September 2009; (9 marks)

(ii) Calculate the amounts that would appear under the headings of ‘cash flows from investing activities’

and ‘cash flows from financing activities’ in the statement of cash flows for Crosswire for the year ended

30 September 2009.

Note: Crosswire includes finance costs paid as a financing activity. (8 marks)

(b) A substantial shareholder has written to the directors of Crosswire expressing particular concern over the

deterioration of the company’s return on capital employed (ROCE)

Required:

Calculate Crosswire’s ROCE for the two years ended 30 September 2008 and 2009 and comment on the

apparent cause of its deterioration.

Note: ROCE should be taken as profit before interest on long-term borrowings and tax as a percentage of equity plus loan notes and finance lease obligations (at the year end). (8 marks)

正确答案:

(i)Thecashelementsoftheincreaseinproperty,plantandequipmentare$5millionforthemine(thecapitalisedenvironmentalprovisionisnotacashflow)and$2·4millionforthereplacementplantmakingatotalof$7·4million.(ii)Ofthe$4millionconvertibleloannotes(5,000–1,000)thatwereredeemedduringtheyear,75%($3million)ofthesewereexchangedforequitysharesonthebasisof20newsharesforeach$100inloannotes.Thiswouldcreate600,000(3,000/100x20)newsharesof$1eachandsharepremiumof$2·4million(3,000–600).As1million(5,000–4,000)newshareswereissuedintotal,400,000musthavebeenforcash.Theremainingincrease(aftertheeffectoftheconversion)inthesharepremiumof$1·6million(6,000–2,000b/f–2,400conversion)mustrelatetothecashissueofshares,thuscashproceedsfromtheissueofsharesis$2million(400nominalvalue+1,600premium).(iii)Theinitialleaseobligationis$10million(thefairvalueoftheplant).At30September2009totalleaseobligationsare$6·8million(5,040+1,760),thusrepaymentsintheyearwere$3·2million(10,000–6,800).(b)TakingthedefinitionofROCEfromthequestion:Fromtheaboveitcanbeclearlyseenthatthe2009operatingmarginhasimprovedbynearly1%point,despitethe$2millionimpairmentchargeonthewritedownofthedevelopmentproject.ThismeansthedeteriorationintheROCEisduetopoorerassetturnover.Thisimpliestherehasbeenadecreaseintheefficiencyintheuseofthecompany’sassetsthisyearcomparedtolastyear.Lookingatthemovementinthenon-currentassetsduringtheyearrevealssomemitigatingpoints:Thelandrevaluationhasincreasedthecarryingamountofproperty,plantandequipmentwithoutanyphysicalincreaseincapacity.Thisunfavourablydistortsthecurrentyear’sassetturnoverandROCEfigures.TheacquisitionoftheplatinummineappearstobeanewareaofoperationforCrosswirewhichmayhaveadifferent(perhapslower)ROCEtootherpreviousactivitiesoritmaybethatitwilltakesometimefortheminetocometofullproductioncapacity.Thesubstantialacquisitionoftheleasedplantwashalf-waythroughtheyearandcanonlyhavecontributedtotheyear’sresultsforsixmonthsatbest.Infutureperiodsafullyear’scontributioncanbeexpectedfromthisnewinvestmentinplantandthisshouldimprovebothassetturnoverandROCE.Insummary,thefallintheROCEmaybeduelargelytotheabovefactors(effectivelythereplacementandexpansionprogramme),ratherthantopooroperatingperformance,andinfutureperiodsthismaybereversed.ItshouldalsobenotedthathadtheROCEbeencalculatedontheaveragecapitalemployedduringtheyear(ratherthantheyearendcapitalemployed),whichisarguablymorecorrect,thenthedeteriorationintheROCEwouldnothavebeenaspronounced. -

第22题:

Faithful representation is a fundamental characteristic of useful information within the IASB’s Conceptual framework for financial reporting.

Which of the following accounting treatments correctly applies the principle of faithful representation?

A.Reporting a transaction based on its legal status rather than its economic substance

B.Excluding a subsidiary from consolidation because its activities are not compatible with those of the rest of the group

C.Recording the whole of the net proceeds from the issue of a loan note which is potentially convertible to equity shares as debt (liability)

D.Allocating part of the sales proceeds of a motor vehicle to interest received even though it was sold with 0% (interest free) finance

正确答案:DThe substance is that there is no ‘free’ finance; its cost, as such, is built into the selling price.

-

第23题:

股东权益变动表(Consolidated Statement of Changes in Shareholders’Equity)CSCSE

正确答案: 是反映企业在某一特定日期股东权益增减变动情况的报表。股东权益增减变动表包括在年度会计报表中,是资产负债表的附表。