AI'm Joe. I-m twelve years old. I like September very much. September 9th is my birthday, and my father's birthday is in September,too.We have a birthday party ev-ery year. Teachers Day is in September, too. And I can play with all my teachers. So Septemb

题目

A

I'm Joe. I-m twelve years old. I like September very much. September 9th is my birthday, and my father's birthday is in September,too.We have a birthday party ev-ery year. Teachers Day is in September, too. And I can play with all my teachers. So September is my favorite. What about you?

( )21.1t is Joe's________ birthday this year.

A. twelve

B.twelfth

C. ninth

D. nine

相似考题

参考答案和解析

更多“AI'm Joe. I-m twelve years old. I like September very much. September 9th is my birthday, ”相关问题

-

第1题:

听力原文:M: We have agreed on the terms of payment. Is it possible to effect shipment in August???

W: I'm afraid not. Mid September, I think.

Q: When is the earliest possible time of shipment?

(13)

A.July.

B.August.

C.September.

D.October.

正确答案:C

解析:当男士问八月是否能出货时,女士给予了否定回答,她认为可能要到"Mid September",所以选项C为正确项。 -

第2题:

(a) An assistant of yours has been criticised over a piece of assessed work that he produced for his study course for giving the definition of a non-current asset as ‘a physical asset of substantial cost, owned by the company, which will last longer than one year’.

Required:

Provide an explanation to your assistant of the weaknesses in his definition of non-current assets when

compared to the International Accounting Standards Board’s (IASB) view of assets. (4 marks)

(b) The same assistant has encountered the following matters during the preparation of the draft financial statements of Darby for the year ending 30 September 2009. He has given an explanation of his treatment of them.

(i) Darby spent $200,000 sending its staff on training courses during the year. This has already led to an

improvement in the company’s efficiency and resulted in cost savings. The organiser of the course has stated that the benefits from the training should last for a minimum of four years. The assistant has therefore treated the cost of the training as an intangible asset and charged six months’ amortisation based on the average date during the year on which the training courses were completed. (3 marks)

(ii) During the year the company started research work with a view to the eventual development of a new

processor chip. By 30 September 2009 it had spent $1·6 million on this project. Darby has a past history

of being particularly successful in bringing similar projects to a profitable conclusion. As a consequence the

assistant has treated the expenditure to date on this project as an asset in the statement of financial position.

Darby was also commissioned by a customer to research and, if feasible, produce a computer system to

install in motor vehicles that can automatically stop the vehicle if it is about to be involved in a collision. At

30 September 2009, Darby had spent $2·4 million on this project, but at this date it was uncertain as to

whether the project would be successful. As a consequence the assistant has treated the $2·4 million as an

expense in the income statement. (4 marks)

(iii) Darby signed a contract (for an initial three years) in August 2009 with a company called Media Today to

install a satellite dish and cabling system to a newly built group of residential apartments. Media Today will

provide telephone and television services to the residents of the apartments via the satellite system and pay

Darby $50,000 per annum commencing in December 2009. Work on the installation commenced on

1 September 2009 and the expenditure to 30 September 2009 was $58,000. The installation is expected

to be completed by 31 October 2009. Previous experience with similar contracts indicates that Darby will

make a total profit of $40,000 over the three years on this initial contract. The assistant correctly recorded

the costs to 30 September 2009 of $58,000 as a non-current asset, but then wrote this amount down to

$40,000 (the expected total profit) because he believed the asset to be impaired.

The contract is not a finance lease. Ignore discounting. (4 marks)

Required:

For each of the above items (i) to (iii) comment on the assistant’s treatment of them in the financial

statements for the year ended 30 September 2009 and advise him how they should be treated under

International Financial Reporting Standards.

Note: the mark allocation is shown against each of the three items above.

正确答案:

(a)Therearefourelementstotheassistant’sdefinitionofanon-currentassetandheissubstantiallyincorrectinrespectofallofthem.Thetermnon-currentassetswillnormallyincludeintangibleassetsandcertaininvestments;theuseoftheterm‘physicalasset’wouldbespecifictotangibleassetsonly.Whilstitisusuallythecasethatnon-currentassetsareofrelativelyhighvaluethisisnotadefiningaspect.Awastepaperbinmayexhibitthecharacteristicsofanon-currentasset,butonthegroundsofmaterialityitisunlikelytobetreatedassuch.Furthermorethepastcostofanassetmaybeirrelevant;nomatterhowmuchanassethascost,itistheexpectationoffutureeconomicbenefitsflowingfromaresource(normallyintheform.offuturecashinflows)thatdefinesanassetaccordingtotheIASB’sFrameworkforthepreparationandpresentationoffinancialstatements.Theconceptofownershipisnolongeracriticalaspectofthedefinitionofanasset.Itisprobablythecasethatmostnoncurrentassetsinanentity’sstatementoffinancialpositionareownedbytheentity;however,itistheabilityto‘control’assets(includingpreventingothersfromhavingaccesstothem)thatisnowadefiningfeature.Forexample:thisisanimportantcharacteristicintreatingafinanceleaseasanassetofthelesseeratherthanthelessor.Itisalsotruethatmostnon-currentassetswillbeusedbyanentityformorethanoneyearandapartofthedefinitionofproperty,plantandequipmentinIAS16Property,plantandequipmentreferstoanexpectationofuseinmorethanoneperiod,butthisisnotnecessarilyalwaysthecase.Itmaybethatanon-currentassetisacquiredwhichprovesunsuitablefortheentity’sintendeduseorisdamagedinanaccident.Inthesecircumstancesassetsmaynothavebeenusedforlongerthanayear,butneverthelesstheywerereportedasnon-currentsduringthetimetheywereinuse.Anon-currentassetmaybewithinayearoftheendofitsusefullifebut(unlessasaleagreementhasbeenreachedunderIFRS5Non-currentassetsheldforsaleanddiscontinuedoperations)wouldstillbereportedasanon-currentassetifitwasstillgivingeconomicbenefits.Anotherdefiningaspectofnon-currentassetsistheirintendedusei.e.heldforcontinuinguseintheproduction,supplyofgoodsorservices,forrentaltoothersorforadministrativepurposes.(b)(i)TheexpenditureonthetrainingcoursesmayexhibitthecharacteristicsofanassetinthattheyhaveandwillcontinuetobringfutureeconomicbenefitsbywayofincreasedefficiencyandcostsavingstoDarby.However,theexpenditurecannotberecognisedasanassetonthestatementoffinancialpositionandmustbechargedasanexpenseasthecostisincurred.Themainreasonforthislieswiththeissueof’control’;itisDarby’semployeesthathavethe‘skills’providedbythecourses,buttheemployeescanleavethecompanyandtaketheirskillswiththemor,throughaccidentorinjury,maybedeprivedofthoseskills.AlsothecapitalisationofstafftrainingcostsisspecificallyprohibitedunderInternationalFinancialReportingStandards(specificallyIAS38Intangibleassets).(ii)Thequestionspecificallystatesthatthecostsincurredtodateonthedevelopmentofthenewprocessorchipareresearchcosts.IAS38statesthatresearchcostsmustbeexpensed.Thisismainlybecauseresearchistherelativelyearlystageofanewprojectandanyfuturebenefitsaresofarinthefuturethattheycannotbeconsideredtomeetthedefinitionofanasset(probablefutureeconomicbenefits),despitethegoodrecordofsuccessinthepastwithsimilarprojects.Althoughtheworkontheautomaticvehiclebrakingsystemisstillattheresearchstage,thisisdifferentinnaturefromthepreviousexampleastheworkhasbeencommissionedbyacustomer,Assuch,fromtheperspectiveofDarby,itisworkinprogress(acurrentasset)andshouldnotbewrittenoffasanexpense.Anoteofcautionshouldbeaddedhereinthatthequestionsaysthatthesuccessoftheprojectisuncertainwhichpresumablymeansitmaynotbecompleted.ThisdoesnotmeanthatDarbywillnotreceivepaymentfortheworkithascarriedout,butitshouldbecheckedtothecontracttoensurethattheamountithasspenttodate($2·4million)willberecoverable.Intheeventthatsay,forexample,thecontractstatedthatonly$2millionwouldbeallowedforresearchcosts,thiswouldplacealimitonhowmuchDarbycouldtreatasworkinprogress.Ifthiswerethecasethen,forthisexample,Darbywouldhavetoexpense$400,000andtreatonly$2millionasworkinprogress.(iii)Thequestionsuggeststhecorrecttreatmentforthiskindofcontractistotreatthecostsoftheinstallationasanon-currentassetand(presumably)depreciateitoveritsexpectedlifeof(atleast)threeyearsfromwhenitbecomesavailableforuse.Inthiscasetheassetwillnotcomeintouseuntilthenextfinancialyear/reportingperiodandnodepreciationneedstobeprovidedat30September2009.Thecapitalisedcoststodateof$58,000shouldonlybewrittendownifthereisevidencethattheassethasbecomeimpaired.Impairmentoccurswheretherecoverableamountofanassetislessthanitscarryingamount.Theassistantappearstobelievethattherecoverableamountisthefutureprofit,whereas(inthiscase)itisthefuture(net)cashinflows.Thusanyimpairmenttestat30September2009shouldcomparethecarryingamountof$58,000withtheexpectednetcashflowfromthesystemof$98,000($50,000perannumforthreeyearslessfuturecashoutflowstocompletiontheinstallationof$52,000(seenotebelow)).Asthefuturenetcashflowsareinexcessofthecarryingamount,theassetisnotimpairedanditshouldnotbewrittendownbutshownasanon-currentasset(underconstruction)atcostof$58,000.Note:asthecontractisexpectedtomakeaprofitof$40,000onincomeof$150,000,thetotalcostsmustbe$110,000,withcoststodateat$58,000thisleavescompletioncostsof$52,000. -

第3题:

hen is the last day to apply for the position with the General Foods Company?A.September 3

B.September 24

C.September 30

D.October 3答案:C解析:由招聘广告中的相关内容可知。投递简历的截止日期为9月30日。答案为C。 -

第4题:

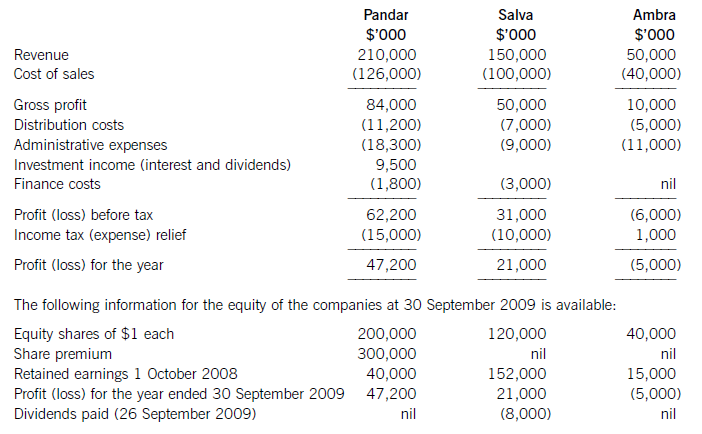

On 1 April 2009 Pandar purchased 80% of the equity shares in Salva. The acquisition was through a share exchange of three shares in Pandar for every five shares in Salva. The market prices of Pandar’s and Salva’s shares at 1 April

2009 were $6 per share and $3.20 respectively.

On the same date Pandar acquired 40% of the equity shares in Ambra paying $2 per share.

The summarised income statements for the three companies for the year ended 30 September 2009 are:

The following information is relevant:

(i) The fair values of the net assets of Salva at the date of acquisition were equal to their carrying amounts with the exception of an item of plant which had a carrying amount of $12 million and a fair value of $17 million. This plant had a remaining life of five years (straight-line depreciation) at the date of acquisition of Salva. All depreciation is charged to cost of sales.

In addition Salva owns the registration of a popular internet domain name. The registration, which had a

negligible cost, has a five year remaining life (at the date of acquisition); however, it is renewable indefinitely at a nominal cost. At the date of acquisition the domain name was valued by a specialist company at $20 million.

The fair values of the plant and the domain name have not been reflected in Salva’s financial statements.

No fair value adjustments were required on the acquisition of the investment in Ambra.

(ii) Immediately after its acquisition of Salva, Pandar invested $50 million in an 8% loan note from Salva. All interest accruing to 30 September 2009 had been accounted for by both companies. Salva also has other loans in issue at 30 September 2009.

(iii) Pandar has credited the whole of the dividend it received from Salva to investment income.

(iv) After the acquisition, Pandar sold goods to Salva for $15 million on which Pandar made a gross profit of 20%. Salva had one third of these goods still in its inventory at 30 September 2009. There are no intra-group current account balances at 30 September 2009.

(v) The non-controlling interest in Salva is to be valued at its (full) fair value at the date of acquisition. For this

purpose Salva’s share price at that date can be taken to be indicative of the fair value of the shareholding of the non-controlling interest.

(vi) The goodwill of Salva has not suffered any impairment; however, due to its losses, the value of Pandar’s

investment in Ambra has been impaired by $3 million at 30 September 2009.

(vii) All items in the above income statements are deemed to accrue evenly over the year unless otherwise indicated.

Required:

(a) (i) Calculate the goodwill arising on the acquisition of Salva at 1 April 2009; (6 marks)

(ii) Calculate the carrying amount of the investment in Ambra to be included within the consolidated

statement of financial position as at 30 September 2009. (3 marks)

(b) Prepare the consolidated income statement for the Pandar Group for the year ended 30 September 2009.(16 marks)

正确答案:

-

第5题:

C

Atnineo'clockintheeveningon15September,1961,MrandMrsHillweredrivingalongMotorway3(3号高速公路)whentheysawaspaceship.

TheydroveontoSandfield,thenexttown.Theygottherethenextmorning.MrHilllookedathiswatch.

"Whydidittakeussolong?"heasked."Threehundredandfourkilometresinsevenhours?"

MrsHillwentwhiteintheface."Somethingisstrange,"shesaid."ButIcan'trememberanything."

Later,withthehelpof,adoctor,theyrememberedeverything.Aftertheysawthespaceship,theygotoutoftheircarand

thenthey"lost"severalhours.

Theyrememberedtheyhearda"bleep,bleep"noisefromthespaceship.Whentheytriedtorunbacktotheircar,there

werethreealiens(外星人)betweenthemandtheircar.

Thealienstookthemtotheirspaceship.TheyaskedthemquestionsaboutthefoodanddrinkonEarth.Theywer

everyinterestedinMrHill'steethbecausehisteethcouldcomeout!

Finally,thealienstookthembacktotheircarandthespaceshipflewaway.

46.WhattimedoyouthinktheHillsarrivedatSandfield?

A.At4a.m.on15September

.B.At4a.m.on16September.

C.At6a.m.on15September.

D.At6a.m.on16September.

正确答案:B