(2012年)甲公司是一家尚未上市的机械加工企业。公司目前发行在外的普通股股数为4000万股,预计2012年的销售收入为18000万元,净利润为9360万元。公司拟采用相对价值评估模型中的市销率估价模型对股权价值进行评估,并收集了三个可比公司的相关数据,具体如下:要求:1)计算三个可比公司的市销率,使用修正平均市销率法计算甲公司的股权价值。2)分析市销率估价模型的优点和局限性,该种估价方法主要适用于哪类企业?

题目

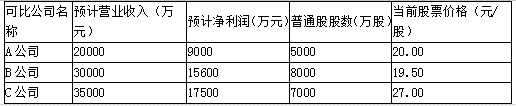

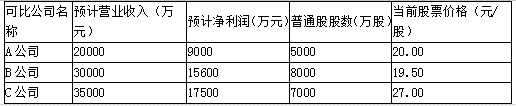

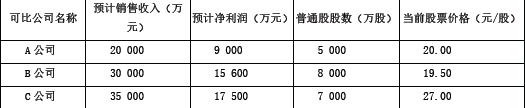

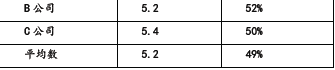

(2012年)甲公司是一家尚未上市的机械加工企业。公司目前发行在外的普通股股数为4000万股,预计2012年的销售收入为18000万元,净利润为9360万元。公司拟采用相对价值评估模型中的市销率估价模型对股权价值进行评估,并收集了三个可比公司的相关数据,具体如下:

要求:

1)计算三个可比公司的市销率,使用修正平均市销率法计算甲公司的股权价值。

2)分析市销率估价模型的优点和局限性,该种估价方法主要适用于哪类企业?

要求:

1)计算三个可比公司的市销率,使用修正平均市销率法计算甲公司的股权价值。

2)分析市销率估价模型的优点和局限性,该种估价方法主要适用于哪类企业?

相似考题

更多“(2012年)甲公司是一家尚未上市的机械加工企业。公司目前发行在外的普通股股数为4000万股,预计2012年的销售收入为18000万元,净利润为9360万元。公司拟采用相对价值评估模型中的市销率估价模型对股权价值进行评估,并收集了三个可比公司的相关数据,具体如下: ”相关问题

-

第1题:

(2014)甲公司是一家尚未上市的高科技企业,固定资产较少,人工成本占销售成本的比重较大。为了进行以价值为基础的管理,公司拟采用相对价值评估模型对股权价值进行评估:

(1)甲公司2013年度实现净利润3000万元,年初股东权益总额为20000万元,年末股东权益总额为21800万元,2013年股东权益的增加全部源于利润留存。公司没有优先股,2013年年末普通股股数为10000万股,公司当年没有增发新股,也没有回购股票。预计甲公司2014年及以后年度的利润增长率为9%,权益净利率保持不变。

(2)甲公司选择了同行业的3家上市公司作为可比公司,并收集了以下相关数据:

要求:(1)使用市盈率模型下的修正平均市盈率法计算甲公司的每股股权价值。

要求:(2)使用市净率模型下的修正平均市净率法计算甲公司的每股股权价值。

要求:(3)判断甲公司更适合使用市盈率模型和市净率模型中的哪种模型进行估值,并说明原因。答案:解析:

由于甲公司的固定资产较少(或者由于甲公司属于高科技企业),净资产与企业价值关系不大,因此,市净率模型不适用;由于甲公司是连续盈利的企业,因此,用市盈率模型估值更合适。 -

第2题:

甲公司是一家尚未上市的机械加工企业。公司目前发行在外的普通股股数为4 000 万股,预计2012年的销售收入为18 000 万元,净利润为9 360 万元。公司拟采用相对价值评估模型中的收入乘数(市价/收入比率)估价模型对股权价值进行评估,并收集了三个可比公司的相关数据,具体如下:

要求:

(1)计算三个可比公司的收入乘数,使用修正平均收入乘数法计算甲公司的股权价值。

(2)分析收入乘数估价模型的优点和局限性,该种估价方法主要适用于哪类企业?答案:解析:(1)计算三个可比公司的收入乘数、甲公司的股权价值:

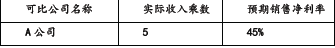

A 公司的收入乘数=20/(20000/5000)=5;

B 公司的收入乘数=19.5/(30000/8000)=5.2;

C 公司的收入乘数=27/(35000/7000)=5.4;

修正平均收入乘数=5.2/(49%×100)=0.1061;

甲公司每股价值=0.1061×(9360/18000)×100×(18000/4000)=24.83(万元);

甲公司股权价值=24.83×4000=99320(万元)。

[或:甲公司每股价值=5.2/(49%×100)×(9360/18000)×100×(18000/4000)×4000=99330.60(万元)]

(2)收入乘数估价模型的优点和局限性、适用范围。

优点:它不会出现负值,对于亏损企业和资不抵债的企业,也可以计算出一个有意义的价值乘数。它比较稳定、可靠,不容易被操纵。收入乘数对价格政策和企业战略变化敏感,可以反映这种变化的后果。

局限性:不能反映成本的变化,而成本是影响企业现金流量和价值的重要因素之一。

收入乘数估计方法主要适用于销售成本率较低的服务类企业,或者销售成本率趋同的传统行业的企业。 -

第3题:

甲公司是一家尚未上市的高科技企业,固定资产较少,人工成本占销售成本的比重较大。为了进行以价值为基础的管理,公司拟采用相对价值评估模型对股权价值进行评估。有关资料如下:

(1)甲公司2019年度实现净利润3000万元,年初股东权益总额为20000万元,年末股东权益总额为21800万元,2019年股东权益的增加全部源于利润留存,公司没有优先股,2019年年末普通股股数为10000万股,公司当年没有增发新股,也没有回购股票,预计甲公司2020年及以后年度的利润增长率为9%,权益净利率保持不变。

(2)甲公司选择了同行业的3家上市公司作为可比公司,并收集的以下相关数据:

要求:

(1)使用市盈率模型下的修正平均市盈率法计算甲公司的每股股权价值。

(2)使用市净率模型下的修正平均市净率法计算甲公司的每股股权价值。

(3)判断甲公司更适合使用市盈率模型和市净率模型中的哪种模型进行估值,并说明原因。答案:解析:

修正平均市盈率=19.4/(8%×100)=2.425

甲公司每股股权价值=2.425×9%×100×(3000/10000)=6.55(元/股)。

(2)

修正平均市净率=3.9/(21%×100)=0.19

甲公司每股股权价值=0.19×14.35%×100×(21800/10000)=5.94(元/股)

(3)甲公司的固定资产较少,净资产与企业价值关系不大,市净率法不适用;市盈率法把价格和收益联系起来,可以直观地反映投入和产出的关系。用市盈率法对甲公司估值更合适。 -

第4题:

甲公司是一家尚未上市的机械加工企业。公司目前发行在外的普通股股数为6000万股,预计2019年的营业收入为24000万元,净利润为12000万元。公司拟采用相对价值评估模型中的市销率估价模型对股权价值进行评估,并收集了三个可比公司的相关数据,具体如下:

可比公司名称 预计营业收入(万元) 预计净利润(万元) 普通股股数(万股) 当前股票价格(元/股)

A公司 21000 9450 5000 21.00

B公司 30000 15300 6000 26.00

C公司 32000 16000 8000 24.00

要求:

<1>?、计算三个可比公司的市销率,使用修正平均市销率法计算甲公司的股权价值。

<2>?、分析市销率估价模型的优点和局限性,说明该种估价方法主要适用于哪类企业。答案:解析:<1>、A公司的市销率=21.00/(21000/5000)=5

B公司的市销率=26.00/(30000/6000)=5.2

C公司的市销率=24.00/(32000/8000)=6

可比公司平均市销率=(5+5.2+6)/3=5.4(1分)

可比公司平均预期营业净利率=(9450/21000+15300/30000+16000/32000)/3×100%=48.67%

修正平均市销率=5.4/(48.67%×100)=11.10%(1分)

甲公司每股股权价值=11.10%×(12000/24000)×100×(24000/6000)=22.20(元)(1分)

甲公司股权价值=22.20×6000=133200(万元)(1分)

<2>、优点:首先,它不会出现负值,对于亏损企业和资不抵债的企业,也可以计算出一个有意义的市销率。其次,它比较稳定、可靠,不容易被操纵。最后,市销率对价格政策和企业战略变化敏感,可以反映这种变化的后果。(2分)

局限性:不能反映成本的变化,而成本是影响企业现金流量和价值的重要因素之一。

市销率估价方法主要适用于销售成本率较低的服务类企业,或者销售成本率趋同的传统行业的企业。(2分)

Answer: (5points)

(1) Company A’s Market price/sales ratio of = 21.00 / (210,000,000/50,000,000) = 5

Company B’s Market price/sales ratio = 26.00 / (300,000,000/60,000,000) = 5.2

Company C’s Market price/sales ratio = 24.00 / (320,000,000/80,000,000) = 6

Average market price/sales ratio of comparable companies= (5+5.2+6) / 3 = 5.4?

Average net profit margin of comparable companies= (94,500,000/210,000,000 + 153,000,000/300,000,000 + 160,000,000/320,000,000) / 3× 100% = 48.67%

Modified average market price/sales ratio = 5.4 / (48.67% ×100) = 11.10%?

Company A’s value per share = 11.10% × (12,000,000/240,000,000) ×100× (240,000,000/60,000,000) = 22.20 (RMB)?

Company A’s total stock value = 22.20×60,000,000 = 1,332,000,000(RMB)?

(2) Advantages: First of all, it does not have negative values. For loss-making enterprises and insolvent enterprises, it can also calculate a meaningful market price/sales ratio. Second, it is stable, reliable and not easily manipulated. Finally, the market price/sales ratio is sensitive to changes in price policies and corporate strategies and can reflect the consequences of such changes.?

Limitations: It cannot reflect the change of cost, which is one of the important factors affecting the cash flow and value of an enterprise.

This method is mainly applicable to service enterprises with low cost of sales or enterprises in traditional industries with similar cost of sales rate. -

第5题:

甲公司是一家从事空调生产、销售的公司,2012年在上海证券交易所上市。为实现企业规模化优势的战略目标,拟收购海外公司乙公司,乙公司是一家拥有专利空调生产技术的生产、销售公司,主要业务集中在M国,享有较高品牌知名度和市场占有率。

甲公司准备收购乙公司100%的股权,拟采用现金流量折现法对乙公司进行价值评估,乙公司相关数据如下:

乙公司2018年税后净营业利润为1000万元,折旧与摊销100万元,资本支出300万元,营运资金增加额为200万元,预计未来各年自由现金流量均按照5%的增长率稳定增长。乙公司的加权平均资本成本为13.2%。乙公司2018年末的债务市场价值为1682.93万元。

乙公司要求的收购报价为6200万元,并购前甲公司股权价值为10000万元,收购乙公司后,预计整合后股权市场价值为16500万元,甲公司预计在并购价款外,还将发生财务顾问费、审计费、评估费、律师费等并购交易费用100万元。

假设以2018年12月31日为并购评估基准日。

要求:

1.从并购双方行业相关性角度,指出甲公司并购乙公司的并购类型,并简要说明理由。

2.根据现金流量折现模型,计算乙公司2018年末的股权价值。

3.计算甲公司并购乙公司的并购收益、并购溢价和并购净收益,并据此指出甲公司并购乙公司的财务可行性。答案:解析:1.并购类型:横向并购。

理由:生产经营相同(或相似)产品或生产工艺相近的企业之间的并购属于横向并购。

2.自由现金流量=1000+100-300-200=600(万元)

乙公司的整体价值=600×(1+5%)/(13.2%-5%)=7682.93(万元)

乙公司的股权价值=7682.93-1682.93=6000(万元)

3.(1)并购收益=16500-(10000+6000)=500(万元)

并购溢价=6200-6000=200(万元)

并购净收益=500-200-100=200(万元)

(2)甲公司并购乙公司后能够产生200万元的并购净收益,从财务管理角度分析,此项并购交易可行。 -

第6题:

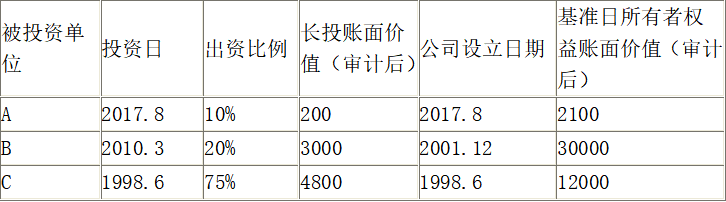

甲公司是一家机械制造企业,为实施供给侧结构性改革,实现“三去一降一补”目标,甲公司股东与债权人商议拟对甲公司实施债转股,委托某资产评估机构对公司股东全部权益进行评估,评估基准日为2017年12月31日,价值类型为市场价值。评估基准日甲公司有3项对外股权投资具体情况如表1所示:

长期股权投资情况统计表 单位:万元

资产评估专业人员拟对C公司采用企业价值评估程序进行整体评估(单独评估),对A公司和B公司不进行单独评估,而是采用简化的评估程序,即按被投资企业经审计后的资产负债表上的净资产数额与甲公司应占份额确定长投评估价值。

C公司为一家设计公司,资产评估人员对C公司分别采用资产基础法和收益法进行评估,采用资产基础法评估时,以审计后的资产负债表列示的全部资产和负债作为评估范围。股东全部权益评估价值为13000万元。采用收益法评估时,股东全部权益评估价值为22000万元,甲公司总部为C公司提供的服务成本在评估基准日现值为2000万元,在C公司盈利预测中未考虑这部分费用。

B公司是一家盈利性比较稳定的企业,且一直对股东分红,近三年甲公司每年均能从B公司收到500万元分红款,预计未来将继续保持此水平。B公司股权资本成本为10%,该投资分红免征所得税。

甲公司房屋评估明细表中有一栋办公楼,账面价值为1000万元,现对外出租,资产评估人员采用收益法对该房地产进行评估时,评估值为3500万元,在无形资产——土地使用权明细表中,该办公楼对应土地使用权账面价值为500万元,评估值为2000万元。资产评估专业人员了解到,甲公司因材料质量问题,与其供应商发生纠纷,要求该供应商赔偿经济损失500万元,该供应商不认可,甲公司已在评估基准日后提起诉讼,目前法院已受理,该事项未在基准日报表中反映。

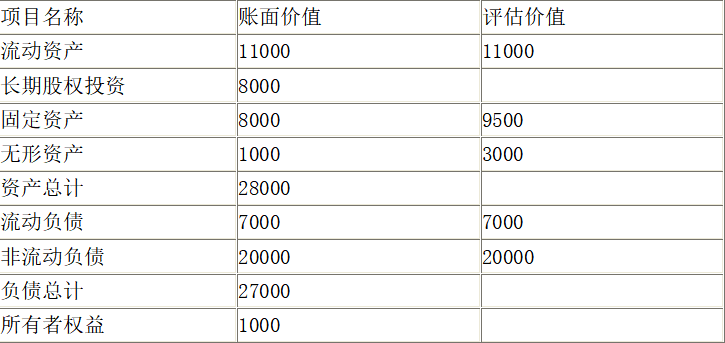

资产评估人员根据已完成的相关工作,得到了资产基础法评估结果的相关数据,详见表2:

评估结果汇总表

要求:

<1>、长期股权投资评估程序是否合理说明理由。

<2>、分析说明长期股权投资评估方法及评估结论的确定方式,并计算评估值。

<3>、估算甲公司资产基础法的评估结果。答案:解析:<1>、 不合理。

对于不具有控制权的长期股权投资,如果该项资产的价值在评估对象价值总量中占比较大,或该项资产的绝对价值量较大,也应该进行单独评估。甲公司占B公司的出资比例虽然只有20%,但是金额较大,因此应当进行单独评估。

<2>、对A公司投资采用资产基础法确定,按被投资企业经审计后的资产负债表上的净资产数额与甲公司应占份额确定长投评估价值。

对A公司投资的评估值=2100×10%=210(万元)

对B公司应采用收益法进行评估,以未来能够获得的收益现值作为评估值。

对B公司投资的评估值=500/10%=5000(万元)

对C公司应采用收益法进行评估,以收益法的评估结果作为评估结论。

对C公司投资的评估值=22000×75%-2000=14500(万元)

<3>、评估结果=11000+210+5000+14500+9500+3000-7000-20000=16210(万元) -

第7题:

A企业拟进行重大资产重组,于2009年2月委托甲资产评估机构对企业股东全部权益价值进行评估,评估基准日为2008年12月31日。经评估人员预测,得到下列相关信息:

(1)A企业经审计后的资产账面价值为28000万元,负债账面价值为15000万元。资产总额的评估价值为37540万元。

(2)A企业未来五年预计可实现的企业自由现金净流量分别为1200万元、1500万元、1300万元、1100万元和1400万元。从第六年开始,A企业的预计企业自由现金净流量将在第五年的基础上,每年递增5%。假设不考虑付息债务的价值。

(3)评估人员选取B公司作为A公司的可比公司,拟利用修正市盈率价值比率测算A公司的股权价值。B公司经调整后的市盈率为21.5,基准日A公司的净利润为1000万元。

经查阅分析相关资料,甲机构确定A企业所在行业的目标资本结构为3:7(债权:股权),债权融资资本成本(税前)为8%,股权融资资本成本为12%。已知A企业适用的所得税税率为25%。

要求:

1.根据上述条件,分别用收益法、市场法和资产基础法评估该企业在持续经营条件下的价值。(折现率保留整数,其余计算结果保留两位小数)

2.对收益法与资产基础法的评估结果差异进行分析。

3.简述资产基础法评估企业价值的操作步骤。答案:解析:1.(1)收益法:

折现率=70%×12%+30%×8%×(1-25%)≈10%

企业未来五年折现值

=1200/(1+10%)+1500/(1+10%)^2+1300/(1+10%)^3+1100(1+10%)^4+1400/(1+10%)^5

=1200×0.9091+1500×0.8264+1300×0.7513+1100×0.6830+1400×0.6209

=4927.77(万元)

企业评估价值=4927.77+[1400×(1+5%)/(10%-5%)]/(1+10%)^5

=4927.77+29400×0.6209

=4927.77+18254.46

=23182.23(万元)

由于不考虑付息债务价值

所以股东全部权益价值=23182.23 (万元)

(2)用市场法评估A企业的股东全部权益价值=21.5×1000=21500(万元)

(3)用资产基础法评估A企业的股东全部权益价值=37540-15000=22540(万元)

2.两种评估结果相差642.23万元,产生差异的原因是资产基础法的评估结论中未包括该企业拥有的商誉价值,相比之下,采用收益法所获得的结果更为合理。

3.根据资产基础法的原理,该方法的基本操作程序应该包括以下六个步骤:获得以成本为基础的资产负债表;确定需要重新评估的资产与负债;确定表外的资产;确定表外或有负债;评估以上确定的各项资产和负债;编制评估结果分类汇总表。 -

第8题:

单选题下列关于市销率倍数法的描述错误的是()。A市销率(P/S)倍数反映了一家公司的股权价值相对其销售收入的倍数

B在使用市销率倍数法估值时,先确定可比公司的市销率作为目标公司估值的市销率倍数,然后使用公式计算目标公司股权价值或每股价值

C股权投资基金投资的创业企业,可能净利润为负数,经营性现金流也为负数,且账面价值比较低

D市销率倍数法的一个局限是不能反映销售收入和成本的影响

正确答案: B解析: -

第9题:

单选题甲公司为一家上市公司,最近五年该企业的净利润分别为2000万元、2400万元、3000万元、3100万元、2800万元。据有关机构计算,该企业过去5年市场收益率的标准差为2.1389,股票收益率的标准差为2.8358,二者的相关系数为0.8。如果采用相对价值模型评估该企业的价值,则适宜的模型是( )。A市盈率模型

B市净率模型

C市销率模型

D净利乘数模型

正确答案: D解析:

如果目标企业的β值为1,则评估价值正确反映了对未来的预期。如果企业的β值显著大于1,经济繁荣时评估价值被夸大,经济衰退时评估价值被缩小。如果β值明显小于1,经济繁荣时评估价值偏低,经济衰退时评估价值偏高。因此,市盈率模型最适合连续盈利,并且β值接近于1的企业。该企业的β=0.8×(2.8358/2.1389)=1.06,由于该企业最近5年连续盈利,并且β接近于1,因此,最适宜的模型是市盈率模型。 -

第10题:

单选题下列关于相对估值法的说法不正确的是()。A评估所得的价值,可以是股权价值,也可以是企业价值

B“可比公司价值/可比公司某种指标”被称为倍数,常用的倍数包括:市盈率倍数、市现率倍数、市净率倍数、市销率倍数等。

C相对估值法的计算公式为:目标公司价值=目标公司某种指标× (可比公司价値/可比公司某种指标)

D相对估值法的基本原理是以可以比较的其他公司(可比公司)的价格为基础,来评估目标公司的相应价值

正确答案: A解析: -

第11题:

单选题甲公司为一家上市公司,最近五年该企业的净利润分别为2000万元、2400万元、3000万元、3100万元、2800万元。据有关机构计算,该企业过去5年市场收益率的标准差为2.1389,股票收益率的标准差为2.8358,二者的相关系数为0.8。如果采用相对价值模型评估该企业的价值,则适宜的模型是( )。A市盈率模型

B市净率模型

C收入乘数模型

D净利乘数模型

正确答案: C解析:

如果目标企业的β值为1,则评估价值正确反映了对未来的预期。如果企业的β值显著大于1,经济繁荣时评估价值被夸大,经济衰退时评估价值被缩小。如果β值明显小于1,经济繁荣时评估价值偏低,经济衰退时评估价值偏高。因此,市盈率模型最适合连续盈利,并且β值接近于1的企业。该企业的β=0.8×(2.8358/2.1389)=1.06,由于该企业最近5年连续盈利,并且β接近于1,因此,最适宜的方法是市盈率法。 -

第12题:

问答题甲公司是一个制造业企业,其每股收益为0.6元/股,预期股利增长率为6%,股票价格为15元/股,公司拟采用相对价值评估模型中的市盈率估值模型对股权价值进行评估,假设制造业上市公司中,股利支付率和风险与甲公司类似的有3家,相关资料如下:使用市盈率模型下的股价平均法计算甲公司的每股股权价值。正确答案:解析: 暂无解析 -

第13题:

甲公司是一家尚未上市的高科技企业,固定资产较少,人工成本占销售成本的比重较大。为了进行以价值为基础的管理,公司拟采用相对价值评估模型对股权价值进行评估,有关资料如下:

(1)甲公司2013年度实现净利润3 000万元,年初股东权益总额为20 000万元,年末股东权益总额为21 800万元,2013年股东权益的增加全部源于利润留存。公司没有优先股,2013年年末普通股股数为10 000万股,公司当年没有增发新股,也没有回购股票。预计甲公司2014年及以后年度的利润增长率为9%,权益净利率保持不变。

(2)甲公司选择了同行业的3家上市公司作为可比公司,并收集了以下相关数据:

要求一:使用市盈率模型下的修正平均市盈率法计算甲公司的每股股权价值。

要求二:使用市净率模型下的修正平均市净率法计算甲公司的每股股权价值。

要求三:判断甲公司更适合使用市盈率模型和市净率模型中的哪种模型进行估值,并说明原因答案:解析:(1)甲公司每股收益=3 000/10 000=0.3(元)

可比公司平均市盈率=(8/0.4+8.1/0.5+11/0.5)/3=19.4 可比公司平均增长率=(8%+6%+10%)÷3=8%

修正平均市盈率=可比公司平均市盈率÷(可比公司平均增长率×100)=19.4÷(8%× 100)=2.425

甲公司每股股权价值=修正平均市盈率×甲公司增长率×100×甲公司每股收益=2.425×9%×100×0.3=6.55(元)

(2)甲公司每股净资产=21 800/10 000=2.18(元)

甲公司权益净利率=3 000/[(20 000+21 800)/2]=14.35% 可比公司平均市净率=(8/2+8.1/3+11/2.2)/3=3.9 可比公司平均权益净利率=(21.2%+17.5%+24.3%)÷3=21% 修正平均市净率=可比公司平均市净率÷(可比公司平均权益净利率×100)=3.9÷(21%×100)=0.19 甲公司每股股权价值=修正平均市净率×甲公司权益净利率×100×甲公司每股净资产=0.19×14.35%×100×2.18=5.94(元)

(3)甲公司的固定资产较少,净资产与企业价值关系不大,市净率法不适用;市盈率法把价格和收益联系起来,可以直观地反映收入和产出的关系。用市盈率法对甲公司估值更合适。 -

第14题:

(2012年)甲公司是一家尚未上市的机械加工企业。公司目前发行在外的普通股股数为4 000

万股,预计2012 年的销售收入为18 000 万元,净利润为9 360 万元。公司拟采用相对价值评估模型中的收入乘数(市价/收入比率)估价模型对股权价值进行评估,并收集了三个可比公司的相关数据,具体如下:

要求:

(1)计算三个可比公司的收入乘数,使用修正平均收入乘数法计算甲公司的股权价值。

(2)分析收入乘数估价模型的优点和局限性,该种估价方法主要适用于哪类企业?答案:解析:(1)计算三个可比公司的收入乘数、甲公司的股权价值:

A 公司的收入乘数=20/(20000/5000)=5;

B 公司的收入乘数=19.5/(30000/8000)=5.2;

C 公司的收入乘数=27/(35000/7000)=5.4;

修正平均收入乘数=5.2/(49%×100)=0.1061;

甲公司每股价值=0.1061×(9360/18000)×100×(18000/4000)=24.83(万元);

甲公司股权价值=24.83×4000=99320(万元)。

[或:甲公司每股价值=5.2/(49%×100)×(9360/18000)×100×(18000/4000)×4000=99330.60(万

元)]

(2)收入乘数估价模型的优点和局限性、适用范围。

优点:它不会出现负值,对于亏损企业和资不抵债的企业,也可以计算出一个有意义的价值乘数。它比较稳定、可靠,不容易被操纵。收入乘数对价格政策和企业战略变化敏感,可以反映这种变化的后果。

局限性:不能反映成本的变化,而成本是影响企业现金流量和价值的重要因素之一。

收入乘数估计方法主要适用于销售成本率较低的服务类企业,或者销售成本率趋同的传统行业的企业。 -

第15题:

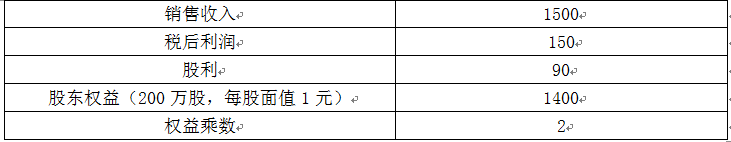

A公司2019年财务报表的主要数据如下:

单位:万元

该公司负债全部为金融长期负债,该公司2019年12月31日的股票市价为15元,假设2019年未增发新股。

要求:

(1)假设公司保持目前的经营效率和财务政策不变,计算2019年的可持续增长率。

(2)计算2019年的市盈率和市销率。

(3)若A公司处于稳定增长状态,其权益资本成本是多少?

(4)若A公司2019年的每股资本支出为0.6元,每股折旧与摊销0.4元,该年比上年经营营运资本每股增加0.2元。公司欲继续保持现有的财务比率和增长率不变,计算该公司每股股权价值。

(5)若A公司的市盈率和市销率与B公司相同。B公司的销售收入为3000万元,净利润为500万元,普通股股数为500万股。请分别用市盈率模型和市销率模型评估B公司的每股股权价值。

答案:解析:(1)2019年留存收益=150-90=60(万元)

2019年的可持续增长率=期初权益本期净利率×本期利润留存率=[150/(1400-60)]×60/150=4.48%

(2)2019年的市盈率和市销率:

市盈率=15/(150/200)=20

市销率=15/(1500/200)=2

(3)若该公司处于稳定增长状态,其股利增长率等于可持续增长率,即4.48%。

目前的每股股利=90/200=0.45(元)

权益资本成本=0.45×(1+4.48%)/15+4.48%=7.61%

(4)每股税后利润=150/200=0.75(元)

2019年每股净经营资产净投资=每股经营营运资本增加额+每股资本支出-每股折旧与摊销=0.2+0.6-0.4=0.4(元)

由权益乘数2,可知资产负债率为50%。

2019年每股股权现金流量=每股税后利润-(1-资产负债率)×每股净经营资产净投资=0.75-(1-50%)×0.4=0.55(元)

每股股权价值=下期股权现金流量/(股权资本成本-永续增长率)=0.55×(1+4.48%)/(7.61%-4.48%)=18.36(元)

(5)用市盈率模型和市销率模型评估B公司的每股价值:

①市盈率模型

B公司的每股收益=500/500=1(元)

B公司的每股股权价值=1×20=20(元)

②市销率模型

B公司的每股销售收入=3000/500=6(元)

B公司的每股股权价值=6×2=12(元)。 -

第16题:

关于企业价值评估的“市销率模型”,下列说法错误的是( )。A、市销率的驱动因素有销售净利率、增长率、股利支付率和风险,其中关键驱动因素是销售净利率

B、不论本期市销率还是内在市销率都不可能出现负值

C、目标公司每股价值=可比公司市销率×目标企业每股销售收入

D、该模型主要适用于需要拥有大量资产、净资产为正值的企业答案:D解析:市销率估价模型主要适用于销售成本率较低的服务类企业,或者销售成本率趋同的传统行业的企业。市净率估价模型主要适用于需要拥有大量资产、净现值为正值的企业。选项D的说法不正确。

【考点“市销率模型”】 -

第17题:

H公司是一家非上市证券公司,丙公司拟将其持有的H公司15%的股权转让给乙公司,委托评估机构对H公司的股东全部权益价值进行评估。评估基准日为2016年12月31日。评估机构拟采用上市公司比较法进行评估。

(1)H公司的股权结构如下表所示:

H公司股权结构表

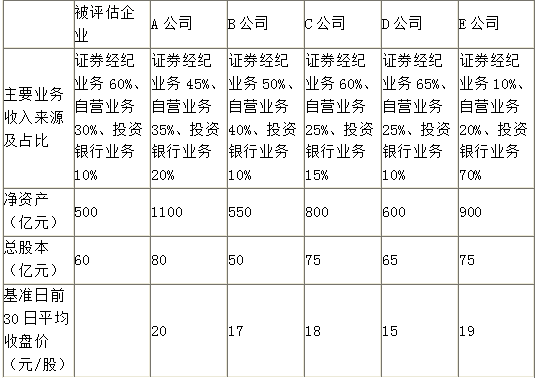

(2)经过初步筛选,评估师拟从五家上市公司中选取可比公司。评估基准日被评估企业和五家上市公司的基本情况如下:

被评估企业及五家上市公司基本信息统计表单位:人民币

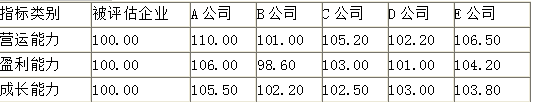

(3)根据H公司行业性质、企业资产构成与业务特点,确定价值比率为市净率P/B,并采用因素调整法对可比公司的价值比率进行调整。被评估企业和五家上市公司各因素评分情况如下:

价值比率调整因素评分表

(4)经调查,评估基准日证券行业缺乏流动性折扣的平均值为27%,控制权溢价平均值为30%。

(5)价值比率调整系数经四舍五入保留小数点后四位数,价值比率和最终评估值经四舍五入保留小数点后两位数。

<1> 、请根据以上资料测算H公司股东全部权益价值。答案:解析:<1> 、 A公司市净率=20×80/1100=1.45

B公司市净率=17×50/550=1.55

C公司市净率=18×75/800=1.69

D公司市净率=15×65/600=1.63

E公司市净率=19×75/900=1.58

修正系数:

A公司:

营运能力:100/110=0.909

盈利能力:100/106=0.9434

成长能力:100/105.5=0.9479

综合修正系数:0.909×0.9434×0.9479=0.8129

调整后市净率=1.45×0.8129=1.18

B公司:

营运能力:100/101=0.99

盈利能力:100/98.6=1.0142

成长能力:100/102.2=0.9785

综合修正系数:0.99×1.0142×0.9785=0.9825

调整后市净率=1.55×0.9825=1.52

CDE公司的计算同理

C公司调整后市净率=1.52

D公司调整后市净率=1.53

E公司调整后市净率=1.37

将各个公司调整后的市净率平均后的值为1.42

H公司全部股东权益价值=500×1.42×(1-27%)=518.30(亿元)

-

第18题:

H公司是一家非上市证券公司,丙公司拟将其持有的H公司15%的股权转让给乙公司,委托评估机构对H公司的股东权益价值进行评估。评估基准日为2016年12月31日。评估机构拟采用上市公司比较法进行评估。

(1)H公司的股权结构如下:甲公司持股比例为51%,乙公司持股比例为34%,丙公司持股比例为15%;

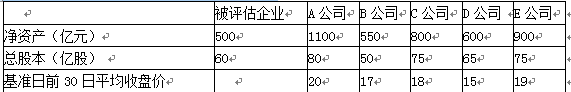

(2)经过初步筛选,评估师拟从五家上市公司中选取可比公司,评估基准日被评估企业和五家上市公司的基本情况如下:

被评估企业及五家上市公司基本信息统计表

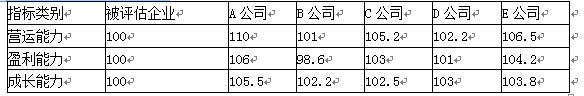

(3)根据H公司行业性质、企业资产构成与业务特点,确定价值比率为市净率P/B,并采用因素调整法对可比公司的价值比率进行调整。被评估企业和五家上市公司各因素评分情况如下:

价值比率调整因素评分表

(4)经调查,评估基准日证券行业缺乏流动性折扣的平均值为27%,控制权溢价平均值为30%。

(5)价值比率调整系数经四舍五入保留小数点后四位,价值比率和最终评估值保留两位小数。

要求:根据以上资料测算H公司股东全部权益价值。答案:解析:(1)计算可比公司市净率

A公司调整前P/B=20×80/1100=1.45

B公司调整前P/B=17×50/550=1.55

C公司调整前P/B=18×75/800=1.69

D公司调整前P/B=15×65/600=1.63

E公司调整前P/B=19×75/900=1.58

(2)计算可比公司调整系数

调整系数计算表

(3)计算可比公司调整后的P/B

A公司调整后P/B=1.45×0.8129=1.18

B公司调整后P/B=1.55×0.9825=1.52

C公司调整后P/B=1.69×0.9004=1.52

D公司调整后P/B=1.63×0.9406 =1.53

E公司调整后P/B=1.58×0.8681=1.37

(4)计算可比公司调整后P/B的平均值

调整后P/B的平均值

=(1.18+1.52+1.52+1.53+1.37)/5=1.42

(5)被评估企业全部股东权益价值

=1.42×500×(1-27%)

=518.30(亿元) -

第19题:

问答题甲公司是一个制造业企业,其每股收益为0.6元/股,预期股利增长率为6%,股票价格为15元/股,公司拟采用相对价值评估模型中的市盈率估值模型对股权价值进行评估,假设制造业上市公司中,股利支付率和风险与甲公司类似的有3家,相关资料如下:分析市盈率估值模型的优点、局限性和适用范围。正确答案: 优点:首先,计算市盈率的数据容易取得,并且计算简单;其次,市盈率把价格和收益联系起来,直观地反映投入和产出的关系;最后,市盈率涵盖了风险补偿率、增长率、股利支付率的影响,具有很高的综合性。局限性:如果收益是负值,市盈率就失去了意义。适用范围:市盈率模型最适合连续盈利的企业。解析: 暂无解析 -

第20题:

单选题D公司为上市公司,2003年4月21日以银行存款800万购买甲企业80%的股权,购买日甲企业所有者权益的账面价值为800万元,评估价值为1000万元。D公司对甲企业的长期股权投资采用权益法核算,应确认的股权投资差额为()A0

B160万元

C80万元

D240万元

正确答案: C解析: 800-(800×80%)=160万元 -

第21题:

问答题甲公司是一家大型连锁超市,具有行业代表性。该公司目前每股营业收入为83. 06元,每股收益为3. 82元。该公司采用固定股利支付率政策,股利支付率为74%,预期净利润和股利的长期增长率为6%。预期营业净利率保持不变。该公司的β值为0.75,假设无风险利率为7%,平均风险股票报酬率为12. 5%。乙公司也是一家连锁超市企业,与甲公司具有可比性,该公司目前每股营业收入为50元。要求:(1)计算甲公司的本期市销率和内在市销率。(2)使用市销率模型估计乙公司每股股权的价值。(3)判断乙公司应使用哪种模型进行估值并简要说明此模型的优缺点及适用条件。正确答案:解析: -

第22题:

单选题某公司年销售收入为5000万元,净利润为300万元,在评估基准日资本*市场上同类上市公司平均市盈率为10,市净率为2。根据上述数据测算,评估基准日该公司的评估价值为()万元。A600

B3000

C10000

D5000

正确答案: D解析: 暂无解析 -

第23题:

问答题甲公司是一个制造业企业,其每股收益为0.6元/股,预期股利增长率为6%,股票价格为15元/股,公司拟采用相对价值评估模型中的市盈率估值模型对股权价值进行评估,假设制造业上市公司中,股利支付率和风险与甲公司类似的有3家,相关资料如下:使用修正平均市盈率法计算甲公司的每股股权价值。正确答案:解析: 暂无解析